This TTWO 0.00%↑ post wraps up our video game series, for now. We urge you to read Part 1 of the series if you’re unfamiliar with the industry, particularly because many of the themes we discuss are both implicitly and explicitly reflected in our assessment of TTWO.

Investment Thesis

Of all the publishers, we think TTWO represents the best value today. The company produces some of the highest-rated video game franchises in the industry, and these franchises have enormous brand value. Under Strauss, TTWO has achieved industry-leading organic growth by leveraging this IP to release new hit titles and offer live-services.

In our view, the market misunderstands TTWO’s revenue growth potential and the operating margin expansion that comes with it. The current price implies that TTWO’s global market share remains flat over the next decade, and we think that’s unlikely for a few reasons:

GTA and RDR are some of the best selling franchises ever, and TTWO keeps releasing titles that achieve new unit sale records. GTA VI should be no different when it’s ultimately released in a few years. The success of the core games has allowed TTWO to build massive persistent online multiplayer games like GTA Online and RDR Online. These universes have helped drive live-service revenue growth of 400% in the last four years, and create sticky users that monetize at much higher operating margins than traditional game sales. The opportunity to continuing growing the live-service business for each franchise is high, and TTWO is rolling out that playbook for other franchises like Borderlands. This should continue to drive high organic growth.

NBA 2K has the box in basketball. It’s even possible that TTWO ultimately secures exclusive licenses for NBA simulation games. The company created a JV with the NBA for an eSport league that is now in its fourth season, and growing in popularity every year. This increases engagement with consumers, and is very difficult to replicate. They also partnered with Tencent to deliver NBA content in China through NBA 2K Online, and Tencent counts 500 mln consumers in China that consume some form of NBA content annually, making basketball one of the most popular sports in the country. TTWO is well positioned to capture meaningful upside in China as console penetration increases and consumers spend more on interactive entertainment in the sport category.

TTWO’s development pipeline for new games is 2.0x larger than it was five years ago. Given TTWO’s relentless focus on quality, we expect some new titles to launch in the coming years with “franchise potential”. With five titles making up nearly 90% of revenue today, just one new enduring franchise can really move the needle.

While M&A has not historically been a core part of the strategy, TTWO now has a balance sheet and cash generating machine to turn on that switch. We expect that M&A could meaningfully increase revenue and operating income if executed well, and our analysis suggests that management has the discipline to do this.

As revenue grows, we expect operating margins to double from 2020 levels, which would take them to roughly the same ballpark that EA and ATVI enjoy today. A big part of that margin expansion expectation is rooted in the secular shift from physical to digital distribution, which we view as a very low risk expectation. The rest is rooted in scale economies, and the data presents lots of evidence for this.

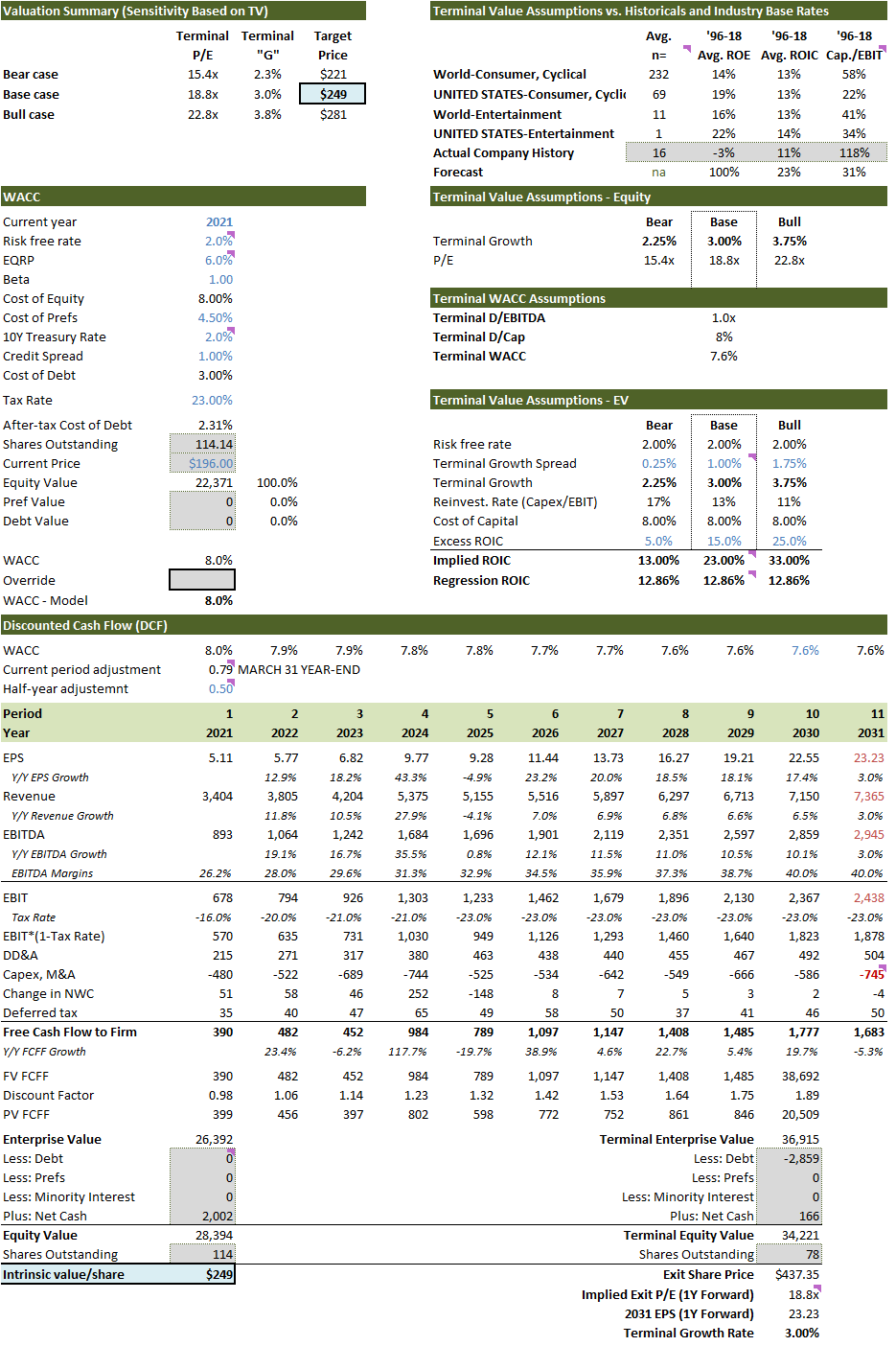

All told, our expectations for market share gains and margin expansion help us arrive at an estimate for fair value of ~$250/share in the base case, which is 27% higher than the current price of $196/share. This is an attractive set-up for a high quality business that’s enjoying the benefits of many secular industry tailwinds.

Content

TTWO’s most popular games include Grand Theft Auto (GTA), Red Dead Redemption (RDR), NBA 2K, Borderlands, BioShock, Max Payne, WWE 2K, Sid Meier’s Civilization, and The Outer Worlds. Cumulatively, GTA is the largest revenue contributor, with the other heavy hitters being RDR and NBA 2K. In the last two annual reports, TTWO reported that their top 5 franchises generated roughly 90% of net revenue, which makes for a fairly concentrated portfolio. We illustrate historical contributions by franchise where available in Exhibit A (note that NBA 2K contributions are estimates).

Given the importance of GTA to TTWO, it’s worth exploring that title in more detail. Rockstar Games, which is a wholly owned subsidiary studio of TTWO, has been developing GTA titles for more than 20 years. GTA V is the most recent iteration and was launched in fiscal 2014, with the predecessor, GTA IV, launched in 2008. With the launch of GTA V, Rockstar also released Grand Theft Auto Online, which is an online multiplayer mode that’s basically a F2P bonus for anyone who purchased GTA V. Like most pure F2P games, new free content is released on GTA Online regularly, which is monetized through microtransactions (MTX). In fact, a standalone version of GTA Online will be released on the next generation of console, which decouples the online multiplayer mode from the core single player game (similar to Warzone and Call of Duty). Some guesswork is required, but we attempted to back out the split between unit sales revenue for GTA V and in-game revenue from GTA Online (Exhibit B). The primary takeaway here is that GTA Online is now a fairly large stand-alone product, which we view as mostly recurring revenue.

Rockstar Games also happens to develop the wildly successful Red Dead Redemption franchise (there must be some creative magic in the water over there). The first iteration was released in 2010, and VGChartz data shows that it sold 7 million copies in the first year and more than 15 million copies by the time RDR 2 was released in 2018. That same data shows that RDR 2 sold nearly 20 million copies in the first year it was released (calendar 2018/fiscal 2019), making it the best- selling console game of the year, generating 25% more revenue than GTA. In fact, RDR 2 was responsible for almost all of the revenue growth at TTWO in fiscal 2019. Similar to how Rockstar rolled out a functionally separate online multiplayer version of GTA, they also released a functionally separate version of online multiplayer for RDR called RDR Online (in late calendar 2019/fiscal 2020). RDR Online will also release new content regularly, and monetize through MTX.

In our view, Rockstar Games is TTWO’s most important label, but it’s closely followed by 2K, which is best known for their NBA, WWE, and PGA games. All these sport titles are developed internally but rely on third-party licenses – similar to EA. What’s really interesting is that 2K hasn’t made a football game in roughly fifteen years, but just received the rights to create non-simulation football content. This could be a step towards direct competition for simulation football titles in 2026 when that license expires with EA. We have no idea how this will play out, but if competition between EA and TTWO over simulation basketball is any indication, this could end up being a big deal for 2K.

In addition to sports, 2K internally develops other fairly popular games like BioShock, XCOM, and Sid Meier’s Civilization. There is lots of good internally developed content within 2K, but one of their most successful series, Borderlands, is developed by an external studio called Gearbox. The first iteration of Borderlands was released in 2009 in partnership with TTWO, and the partners released Borderlands 3 in 2019 (fiscal 2020), which has since sold more than 10 million units. The release of this title likely accounts for much of the revenue growth in fiscal 2020. Much like GTA and RDR, Gearbox is now offering ongoing content releases for Borderlands 3, which should result in incremental in-game sales.

Most of TTWO’s large franchises are produced out of Rockstar and 2K, but the Private Division is an important potential pillar for the company. TTWO partners with many independent developers, and some of the more successful titles from these partnerships include The Outer Worlds and Kerbal Space Program. We estimate that the Private Division contributes 5-10% of total revenue, so isn’t very meaningful today. That being said, the development budget for these titles tends to be relatively low, and it allows TTWO to take lots of swings at new content. In our view, it’s a great incubator for new franchises.

Lastly, Exhibit C shows that console games have dominated TTWO’s line-up for years, and that the mobile business was effectively non-existent until a few years ago when they acquired Social Point. In fiscal 2021, TTWO also acquired PlayDots, which we guess might increase mobile revenue by ~40-50%. Either way, it’s a small part of the business today, but one that we’d expect to grow proportionally over time. Notably, other large publishers have leveraged PC and console IP into new mobile titles, and TTWO has yet to do this. It’s hard to tell if games like GTA or RDR would translate well into mobile, but it’s a potentially large lever that TTWO has yet to pull.

Competitive Position

Rockstar - Brands and Players First

TTWO has produced a lot of great content over the last twenty years, much of which flourished into big enduring franchises. As we touched on in our ATVI post, many big enduring franchises build up enormous brand value, and that’s definitely true for TTWO. Borderlands, Max Payne, NBA 2K, and BioShock are all great, but the creme de la creme is without a doubt the Rockstar duo: GTA and RDR.

RDR, RDR 2, GTA III, GTA IV, and GTA V have each achieved a Metacritic rating in the top 99.8% of all games in the last twenty years. That’s a phenomenal achievement, and the benefits of producing great content are obvious. The GTA franchise is so widely known and well-liked, that when GTA V was released in 2013 it was by far the best-selling game of the year - taking share from all other publishers. It also massively outsold its predecessor, and has since gone on to sell millions of additional units in every year since launch. Similarly, RDR was such a hit that RDR 2 also became the best-selling game in the year it was released. As the global gamer community grows, these brands will attract many of the incremental console players with much lower marginal customer acquisition costs. We expect the unit cost of S&M to fall as a result.

Having a big player install base also makes it easier to grow live-service revenue like Rockstar did with GTA Online. The brand brought players into the universe, and the incremental content drops kept them engaged and monetized for years after the initial game sale. GTA Online has been so successful that Rockstar is going to monetize it directly through a standalone experience on the next generation of console. It’s not yet clear to us, but if GTA Online and the core GTA game become totally standalone products, this would be akin to a price increase, and pricing power is a great indicator of brand value. This playbook works well when the core game is a success, and TTWO is clearly using it on other franchises like Borderlands.

It’s difficult to understand how TTWO has been able to deliver such universally acclaimed content, and build such strong brands, but as we look at the publisher landscape we notice that TTWO seems to have some of the longest release cycles between games in a franchise. GTA V is coming up on it’s eight year anniversary, and a revamped version of the same game is even being released on the next generation of consoles, while RDR 2 was released eight years after the first iteration. With the exception of a few sport titles like NBA 2K, this seems to be the norm. They don’t release annual versions of GTA like ATVI does with CoD, nor do they seem to ever rush content like EA did with Anthem. At an investor meeting last year, Strauss even mentioned that TTWO doesn’t announce new titles until 4-6 months before release, specifically so that they don’t risk releasing something that isn’t ready and flops. By all appearances, TTWO seems to value the production of best-in-class content over everything else, and much more so than competitors.

We find more evidence of this when we evaluate their approach to mobile game development. ATVI and EA have both leveraged their PC and console IP to create mobile titles, while TTWO has not. When asked about this on the most recent conference call, the CEO, Strauss Zelnick, made a few interesting comments:

“Some of our competitors have taken legacy IP and created mobile titles with that IP…. The world in which we would do that is when our labels are excited about the opportunity creatively, and when we think we can deliver something to consumers that is absolutely stellar.“

“We wouldn’t rule out making a stand-alone mobile title based on [our console and PC IP], but it would be driven by the labels creative desire to do so, and the belief that we could do an extraordinary job at it.”

“It’s not lost on us that the biggest hits in the mobile business are native to mobile. They are not based on licensed IP. They are not based on console IP.“

What this shows us is that TTWO isn’t necessarily interested in squeezing the next penny out of their existing IP, but rather are more concerned about creating exceptional content for their users. It also shows that the management team is taking direction from creative teams, and not the other way around. Patience is a virtue, right? This is important, and could very well be a cultural edge. We therefore have some confidence that TTWO will produce proportionally more successful original AAA content in the future than any of their competitors, while simultaneously growing existing franchises with established brands.

Basketball - Brand, Scale, First Mover

NBA 2K is one of TTWO’s most important franchises as we showed in Exhibit A, and it’s impacted by many of the same licensing dynamics that we highlighted in our EA post. Unfortunately, the NBA does not grant exclusive licenses to developers, so NBA 2K has to contend with EA’s NBA Live series. Fortunately, that competition has been weak. Since 2006, TTWO has published 16 consecutive NBA 2K titles, while EA has only published 10 NBA Live games. EA’s inconsistent delivery of basketball titles almost certainly led them to lose share to TTWO. Specifically, EA failed to launch an NBA Live title in 2011, 2012, 2013, 2017, 2020, and 2021. Over that same period, TTWO reported that NBA 2K sales increased six-fold, from just 2 million for NBA 2K10 to more than 12 million for NBA 2K20. We don’t have any data from EA on NBA Live sales, but we estimate that unit sales for EA’s latest iteration (NBA Live 19) were some small fraction of NBA 2K19. For what it’s worth, NBA 2K has something like 40x more followers on Twitch than NBA Live. It’s not even close.

We don’t have a great handle on why EA dropped the ball (pun intended) on NBA Live, but now that TTWO dominates this niche, it will be hard for EA to recover. One reason is that NBA 2K has a stronger brand than NBA Live, particularly after EA’s inconsistent release cycle and seemingly worse game play. TTWO has also done a good job at building out an eSport league before EA. The NBA 2K League is a JV with the NBA, and is now in its fourth season. According to Forbes, the NBA 2K League Finals last season received 1.1 mln viewers from Twitch alone, and it’s also streamed on ESPN2, Sportsnet, and Youtube. By any measure it appears to be a big success, and at this point, the NBA isn’t going to cannibalize the JV with TTWO by starting up a new league with EA. The league helps with user engagement, and should bring many consumers back to each successive iteration of NBA 2K. That’s a difficult perch to compete with.

Another important reason that makes it difficult for EA to compete is that TTWO has a major scale advantage. Last year, TTWO announced a seven-year license extension with the NBA that was reportedly worth $1.1 bln, or $157 mln/year. A big part of that royalty is going to be variable, but it would also include a minimum guarantee that EA would also have to meet. If the minimum guarantee was 25% of TTWO’s expected royalty ($40 mln/year), then we estimate that EA would need to sell something like 2.0 mln units just to break even. They’d have to sell close to 3.0 mln units to earn a reasonable operating margin. We don’t see that happening after a two-year hiatus unless EA invests significantly more in these titles, and even then it would take years to regain consumer trust. Alternatively, EA could cut the development budget of the games, but then they’d continue to produce sub-par content. Either way, we don’t see TTWO losing the NBA throne, and in due course it’s totally possible that either A) EA stops trying to compete in basketball, or B) the license just becomes exclusive to TTWO.

Much to our surprise, a huge part of NBA 2K’s franchise success has come from a partnership with Tencent that they initiated 10 years ago to distribute NBA-licensed content in China. By 2012, the partnership had released NBA 2K Online to Chinese consumers. Since then, this F2P PC game has accumulated more than 50 mln registered users, making it the number one PC sports title in China. It’s extremely difficult for western publishers to release content in China without a partner, so this Tencent partnership is extremely valuable. This first mover advantage in the biggest video game market in the world also makes it difficult for EA to compete for global share. What’s more, Tencent estimates that there are more than 500 mln Chinese fans consuming NBA content, making it one of the most popular sports in the country. We expect that NBA-specific interactive entertainment spending in China will grow significantly over the next twenty years, and TTWO is extremely well positioned to capture that upside, particularly as console penetration increases.

Lastly, we note that TTWO is increasing pricing for NBA 2K on next generation consoles. We don’t expect that this will have any meaningful impact on unit sales considering the lack of alternatives, engaged users, and arguably still great value. This price increase should meaningfully impact operating margins, particularly considering that R&D and S&M expenses won’t increase proportionally. If we’re right that demand elasticity to price is close to zero, this would be a great reflection of NBA 2K’s competitive position in basketball.

Scale

Scale at the company level by itself doesn’t make TTWO a more effective competitor versus big publishers like EA, but it should help against virtually any indie developer. For example, most indie developers can’t afford to have the same patience with the development cycle as TTWO does with all their games (ex. NBA). It’s also harder for small developers to take risks, and their development and marketing budgets are typically more constrained. In our view, scale should make it easy for large publishers like TTWO to maintain share at a minimum, and more likely gain share in console and PC.

More importantly, it seems to be true that marginal profit increases with each incremental unit sold under a franchise, so the biggest franchises should earn the highest margins. Scaling up a handful of big franchises, and then growing a bunch of smaller ancillary ones, has indeed led to substantial margin expansion at EA and ATVI. The margins that these big competitors enjoy is only possible at scale, and we think these benefits will ultimately accrue to TTWO as their business grows. Exhibit D shows the relationship between revenue and all the expense items in-between gross profit and operating profit. There is some noise in the data, and it’s difficult to compare perfectly across publishers, but we believe this graph illustrates that scale reduces the unit cost of R&D, S&M, and G&A. We’d expect operating margins and return on capital to improve significantly for TTWO within the next decade as a result.

Strategy

In our mind, the keystone of TTWO’s strategy is to produce exceptional content and make it as widely available as possible. Relative to other developers, TTWO seems to prefer quality to quantity. The creative-led product development process that we touched on earlier seems to be a reflection of this, and TTWO clearly believes that they differentiate themselves by focusing on content quality over all else.

“We believe that our commitment to creativity and innovation is a distinguishing strength, enabling us to differentiate our products in the marketplace by combining advanced technology with compelling storylines and characters that provide unique gameplay experiences for consumers.“

If TTWO can successfully produce best-in-class content, management believes that it’s easier to create enduring franchises with sequels, live-service revenue opportunities, and eSports potential - all of which help drive margin expansion. In fact, all of TTWO’s largest revenue contributors to-date have come from franchises (GTA, RDR, NBA 2K, Borderlands, etc.) with multiple titles and significant live-services revenue. In our view, leveraging existing franchises to drive live-service revenue has been the single largest contributor to revenue growth and margin expansion over the last five years, and management clearly understands this. Exhibit E shows how TTWO’s revenue split has tilted away from full-game sales and toward recurrent spending (live-services). Full-game sales in absolute dollars has increased since 2017, but recurrent spending is up over 400%. Growing live-service revenue after a successful game launch is clearly another important part of the strategy.

We believe that the playbook today is to A) continue reinvesting in proven existing franchises through subsequent titles and more in-game content, and B) invest heavily in creating new original titles that have “franchise potential”, and live-service monetization opportunities. To that last point, we note that TTWO now has more than 4,300 employees working specifically on game development at 23 studios, up from 2,100 employees in 17 studios just five years ago. They are clearly adding more studios and more people per studio. Some part of this headcount expansion has to be related to live-service growth, but we expect that the majority is tied to investments in new content. Management has even indicated that TTWO’s development pipeline is twice as large as it was five years ago. Given management’s focus on quality over quantity, we’re reasonably confident that this growing development pipeline will spin out some very well received titles, and most likely leads to an increase in market share.

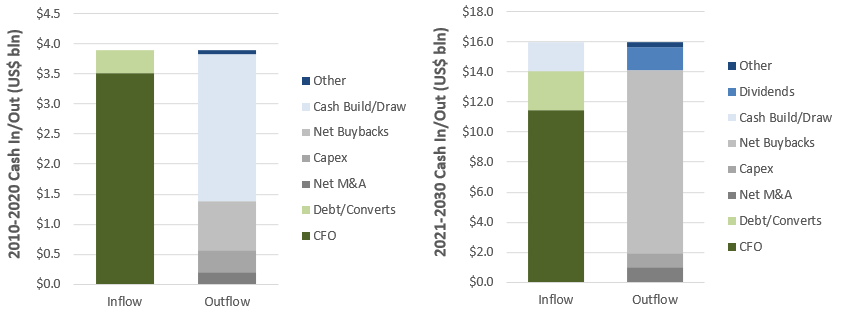

On the capital allocation front, we note that TTWO has been relatively inactive. In fact, they have accrued proportionally more cash than both ATVI and EA (Exhibit F). The primary reasons are that for the decade ending in fiscal 2020, both M&A and buybacks were relatively non-existent (Social Point was quite small), TTWO hasn’t paid a dividend, and capitalized growth spending is de minimis. This lack of activity makes it difficult to assess the capital allocation strategy.

That being said, recent developments and management commentary help give us some idea about how they think about deploying capital. In the 2020 annual report, they specifically mention buybacks:

“We also have the ability to return capital to shareholders, including through opportunistic share repurchases“

The operative word here is “opportunistic”. Clearly TTWO isn’t keen on systematic buybacks or dividends, because over time those options should only earn the company’s cost of capital, and TTWO is clearly looking for cost of capital plus some spread.

We also note that many strategically-important acquisitions might require larger checks, so it could very well make sense to accumulate sufficient cash to execute on strategic M&A versus returning smaller cash balances systematically. In late calendar 2020, TTWO offered to acquire Codemasters for ~$1.0 bln, and even though EA subsequently outbid them, it does show that TTWO is looking to deploy capital to acquire good IP. They also acquired PlayDots and Ruffian in the first quarters of fiscal 2021. For each of these acquisitions, we can wrap our head around how TTWO can generate both revenue and cost synergies, so we’re encouraged to see cash deployed in this way. It’s unclear how the bidding for Codemasters will play out, but we would take it as a positive sign of capital allocation discipline if TTWO walked away rather than engaging in a bidding war.

To summarize, we think commentary and recent activity shows that TTWO has a bias to pursuing M&A over distribution of cash to shareholders. That being said, large M&A is clearly difficult to execute on, and cash balances are getting sufficiently large that they probably pursue both over the next decade.

Performance

Exhibit G shows TTWO’s global share of content sales by platform from 2013 to 2020, and they have clearly gained share fairly consistently in every category. Excluding the Social Point mobile acquisition, all of this growth has been organic, and has resulted in a 15% top line CAGR during the period. This historical organic growth rate was roughly 2.0x higher than both ATVI and EA. By any measure, the company has done a great job in recent years at delivering compelling new content to a growing global audience of gamers.

From 2013 to 2020, just as TTWO was experiencing significant top-line growth, the industry also underwent a major shift from physical to digital distribution of content. For TTWO, digitally delivered content went from 21% of total revenue in 2013 to 77% in 2020, and adjusted gross margins went from 62% to 71% as a result. This industry tailwind benefited all the publishers, and TTWO’s gross margin expansion was more-or-less in-line with peers after adjusting for content mix. Operating margins have expanded slightly more than gross margins as TTWO realizes some scale benefits, and the company is now sustainably achieving record-high operating margins, although we note that their operating margins are still much lower than peers.

Strong top-line growth, scale benefits, and industry tailwinds all led to meaningful growth in EPS and CFPS over the last 7 years (Exhibit H). Evaluating historical ROE and ROIC is difficult for a few reasons, but we’ve included the historical figures anyway. It’s no surprise that both ROE and ROIC jumped significantly as TTWO gained share and realized margin expansion, and the company is clearly earning in excess of their cost of capital today. It looks weird that ROIC is so much higher than ROE, but it’s because invested capital is now lower than the book value of equity, largely as a result of negative NWC and an absence of debt. We also note that TTWO’s cash and short term investment balances are nearly equivalent to the book value of equity, so if the company returned that cash to shareholders, reported ROE would be somewhere close to 100%.

Prior to 2013, TTWO struggled to release new content and to maintain positive operating margins, and all profitability metrics reflected that. We’ll expand on what changed under Management & Governance, but the short version is that an activist campaign ultimately put Strauss Zelnick in the CEO seat in 2011, which he holds to this day, and performance has improved significantly under his leadership.

Financial Position

TTWO has no debt, and a growing cash position, which now represents 50% of total assets as shown in Exhibit I.

As we touched on earlier, TTWO has accumulated proportionally more cash than any of their peers, and has been relatively inactive with buybacks and M&A until recently. Exhibit J shows historical cash inflows/outflows and the forecast in our base case. In our view, pressure is mounting to do deploy accumulated capital, and TTWO is in a great position to simultaneously return more capital to shareholders and pursue inorganic growth. On the most recent conference call, Strauss specifically mentioned that:

“We have almost $2.4 bln in cash. No debt. And we are anxious to build our business aggressively“

We ran a quick data table to see what kind of EBITDA uplift TTWO could expect on 2021E EBITDA if they deployed all of their cash balance on M&A under a range of different EV/EBITDA metrics. We note that Social Point was likely acquired at 12.5x trailing, Playdots at 12-14x trailing, and Codemasters would have been in the 15-20x range on fiscal 2021 numbers had TTWO been successful. If we assume that 15.0x is the magic number, than TTWO could increase EBITDA by ~20% by deploying current excess cash balances through acquisitions. That likely translates to an EPS uplift of 15%, which would be greater than the uplift from repurchasing shares, and would have the added benefit of growth from acquired assets. We would prefer to see more M&A and fewer buybacks, but given the difficulty with finding and executing on the right acquisitions, we remain skeptical that a significant portion of future available cash will go this route.

Management & Governance

A long time ago, in a land far far away, TTWO was a governance nightmare. By 2007, the company was under investigation by the SEC, IRS, and NY DA’s office for “minor” things like accounting fraud and a stock-option backdating scheme. There were also complaints about hidden sexual content in GTA around the same time. To make matters worse, revenue was stagnant and the company was consistently reporting negative net income. A Reuters article from 2007 quotes a Wedbush Morgan analyst as saying:

“Replacing the board is a good thing. I think it’s very healthy to flush everybody. They complicated abdicated any responsibility for the oversight of the options-granting policy. A more responsible board would have committed hari-kari.“

Yikes.

Despite management and governance issues, the underlying content was still quite attractive. So in 2007, a handful of large investors representing 46% of shares outstanding, including ZelnickMedia (ZMC; owned by Strauss Zelnick), successfully ousted the board and installed their own leadership team. Strauss became the Chairman in 2007 and ultimately took over the reigns as CEO in 2011. Both positions he holds to this day.

Before forming ZelnickMedia and taking the reigns at TTWO, Strauss was the CEO at Crystal Dynamics (now part of Square Enix), the COO at 20th Century Fox, and the CEO of BMG Entertainment. In our view, this gives him some serious breadth in the entertainment business, and helped him understand that A) quality content is all that matters, and B) quality content depends on talent. Finding and nurturing that talent, and letting creative teams inform the development pipeline, are big reasons that TTWO has been successful since he took over.

A couple things we love about Strauss is his ability to honestly and clearly assess the present, and simultaneously make multi-decade decisions. In his late-30’s, he left his lucrative role as CEO of BMG Entertainment because he felt like the music business was cresting (which it was). He was also concerned that if he remained on his current trajectory he’d end up being unemployed in his mid-60’s, and he clearly had every intention of working much later than that. In this 2018 interview with Walker & Dunlop, he said:

“The only people in the media and entertainment space that don’t seem to have an expiration date are the owners. Rupert Murdoch is nearly 90. Summer Redstone is 95. John Malone, etc. The only people who aren’t subject to ageism in this business are the owners. So, if I am successful at building my own thing, I can do it for as long as I want to“

So he goes off and starts ZMC with the intention of building a media empire that he can run as long as he’s fit and able. And to make sure he’s fit and able, he stops drinking, and focuses intently on health:

“What a good diet and a lot of exercise does, is makes you feel really good for a really long time. You have the ability to live like a middle-aged person to the very end”

At 63, he might seem long in the tooth, but he appears anything but. And he still has that long-term mentality:

“To the extent that we built anything at all, we built it based on a view of not where the media business was in 2001, but where it would be in 2025. Here in 2018, we’re thinking about 2030. That’s how we invest, and I find that incredibly exciting“

What’s equally impressive is his ability to pair long-term thinking with a kaizen mindset. Nothing about him is static:

“Any time you look at yourself or your business and think ‘I’ve got it all figured out, I’ve nailed this thing’… I really encourage you to retire”

Overall, we think Strauss has multiple competitive advantages as a leader, and a great track record at TTWO. As prospective investors, we like that he’ll probably be in the CEO seat for many years to come. We also note that Glassdoor reviews of Strauss show he has a 99% CEO approval rating, which is insanely high.

Strauss, through ZMC, owns ~$160 mln of TTWO stock. Karl Slatoff, another ZMC executive and the President of TTWO, owns another ~$120 mln. Cumulatively, all insiders sit on close to $400 mln of stock, which represents a significant portion of their net wealth as far as we can tell. Of the eight directors on the board, four were appointed in 2007 following the shareholder activism, and the other four have taken their seats within the last five years. It’s encouraging to see such high ownership and a refreshed board.

Management compensation arrangements seem to be a point of contention for some investors, specifically the fact that Strauss and Karl are paid through ZMC. That being said, TTWO hasn’t faced the same problems with say-on-pay votes as EA and ATVI, and the board seem to be more open to investor feedback on a broad range of subjects, which we view as a great practice:

“In the months leading up to the filing of this Proxy Statement, we sought discussions with holders of over 69% of our outstanding shares (percentage based on the Company’s investors’ most recent filings at the time of outreach) and had discussions with a number of our top holders. Throughout these discussions, we sought shareholder feedback on a wide range of topics, including the ZelnickMedia management agreement, environmental, social and corporate governance (“ESG”) matters, and Board composition matters“

The vast majority of NEO compensation is tied to performance, which is measured by Adjusted EBITDA targets, relative TSR, new content releases, spending, and recurring consumers. Incentives and compensation levels all seem reasonable.

Lastly, roughly two-thirds of TTWO’s Stock Incentive Plan is awarded to employees at their various labels, and roughly 60% of all employees are eligible to participate. Historical internal royalty and stock-based compensation figures lead us to believe that employee ownership must be quite high, particularly at the largest labels like Rockstar. This fits with management’s philosophy of making sure employees are “financially and emotionally” aligned to create value. It’s also one reason that we suspect Glassdoor reviews are so high.

Valuation & Scenarios

Revenue

Similar to how we modelled the top-line for ATVI and EA, we think about long-term top-line growth for TTWO in the context of our industry growth outlook from Part 1. A summary of our market share assumptions can be found below.

In the console business, TTWO has gained significant share in recent years, and we expect that to continue for a few reasons. First, the development pipeline is 2.0x larger than it was five years ago, and we feel reasonably confident that some high-quality new console games are tucked away in there. Some of that new content would include non-simulation football titles. Second, we assume GTA VI is released at some point in the future (arbitrarily 2024), and that the title A) realizes record initial unit sales, and B) permanently grows the player base for GTA Online. Third, TTWO is positioned well to continue growing live-service revenue from franchises with good brands and a large player base. Fourth, even though the console market in China is small today, we expect it will grow meaningfully over the next ten years. We expect that TTWO is positioned to grow NBA-related content sales in China as a result (beyond the NBA 2K Online PC game). And lastly, TTWO has raised pricing on some next-generation games already, and given the quality of TTWO’s game slate, we suspect they generally have better pricing power than the console universe at large.

The PC business grew substantially in fiscal 2020 with the release of RDR 2 on PC, Borderlands 3, and The Outer Worlds. We expect this step change in revenue and market share to be permanent, and actually increase in the future. Part of that expectation is rooted in the idea that some of TTWO’s most successful console content like GTA and RDR should translate well to PC, and that penetration of these titles in the PC market is still quite low. When GTA VI is launched, we’d expect an increase in PC unit sales for the title, and for subsequent growth in the GTA Online PC community, similar to what we’ve observed for RDR 2. We also expect that part of the bigger development pipeline consists of new PC titles, and that revenue from NBA 2K Online will grow in China faster than growth in the global PC market.

On the mobile front, we note that hit-rates for new mobile titles are very low, largely given the intense competition in this space. We are generally skeptical that TTWO will be able to significantly increase market share organically with new mobile-specific content, and assume that they continue to pursue some M&A in the space (our base case has $1.7 bln of total M&A through the forecast period, and we suspect a good chunk will be on mobile developers). As a result, we assume total mobile gross revenue reaches $750 mln by 2030, up from an estimated ~$250 in 2021, which takes market share up roughly 50% from 2021. Some part of this growth might also come from the release of mobile content that is based on TTWO’s console and PC IP, something they have yet to do.

Tying it all together, our base case has TTWO’s global content market share going from 9.5% to 12.5%, which drives net revenue growth through the forecast period of 8-9%/year, versus a CAGR of 15% over the last decade.

Gross Margin

Roughly 23% of TTWO’s 2020 revenue came from physically distributed content, and we expect that to fall to 6% in the base case. This is the primary driver behind our gross margin expansion assumptions in the base case (Exhibit N). We note that TTWO reports “internal royalties” in cost of goods sold, which ATVI and EA would have reported below the gross profit line. This makes gross margins look much lower for TTWO than competitors in any comparable analysis, so we adjust for this in Exhibit N.

Like all the publishers, TTWO incurs software development costs, and can choose to either expense or capitalize those outflows. In fiscal 2019 and 2020, the company expensed a significantly higher proportion of those costs than in prior years, which also meant that they capitalized a much lower share and software development assets on the balance sheet fell significantly. When we normalize for this, run-rate gross margins for 2019 and 2020 would have been higher. This explains most of the year/year gross margin expansion we’ve modelled for 2021 in the base case - note that in 1H21, TTWO has continued to disproportionately expense software development costs (very little capitalized), so margins are lower than we’ve modelled for the full year. The total dollars spent aren’t changing, just moving from one bucket to the next, so it doesn’t matter to our valuation where it ultimately ends up.

Operating Margin

Operating margins will be positively impacted by gross margin expansion and items we touched on above, but we also expect R&D, S&M, G&A, and (to a lesser extent) internal royalties to fall as a percentage of revenue. TTWO should continue to benefit from scale as core franchises grow, particularly as live-service revenue becomes a bigger part of the total. As such, operating margins improve by 8% more than gross margins in our base case. Our terminal operating margin assumption of 33% is A) roughly in-line with operating margins at ATVI and EA today, and B) much lower than the terminal operating margin assumptions we had for both other companies. To that last point, we note TTWO will still be a smaller business, and generally seems to pay employees more (through profit sharing), which we don’t expect to change. We also note that TTWO doesn’t have a single internal game engine like EA (Frostbite), nor do they have many annually recurring franchises to help lower R&D/title (like ATVI and CoD).

Underutilized Balance Sheet

As we’ve touched on at multiple points, TTWO is flush with cash and looking to deploy it. In our base case, we assume that they meaningful ramp up buybacks, eventually institute a dividend, and successfully execute on $1.7 bln of M&A through the forecast period. By our terminal year, we take ND/EBITDA to 1.0x (ignoring restricted cash). These actions should reduce cash drag and improve profitability metrics.

The Outputs

In the base case, revenue, net income, and EPS CAGR’s are roughly 9%, 16%, and 20% respectively through 2030. These are all lower than trailing growth rates, but significantly higher than what we assume for the peer group. Our base case estimate of fair value works out to ~$250/share, which is 25-30% above the current price of $196/share. A summary of our DCF can be found below, and the full model at the top of this post.

Exhibit Q shows how we arrive at our bull and bear case (loosely representing our 10th and 90th percentile outcomes).

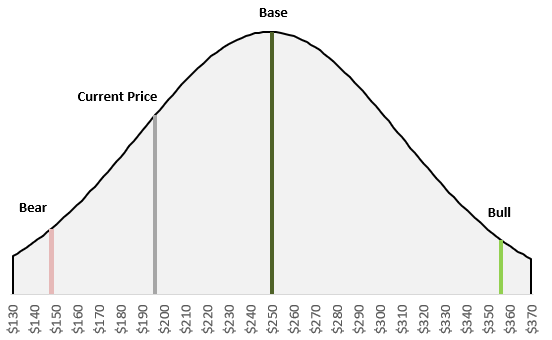

When we plot our scenarios versus the current price in a hypothetical normal distribution, as seen below, it shows that we believe risk is skewed to the upside.

If the market is mispricing TTWO, the logical next question is why? Our valuation is clearly most sensitive to revenue growth (A) and operating margins (C) as seen in Exhibit Q, so the answer probably lies there. Operating margins are partly a function of revenue growth, because of scale benefits, so the real differentiator is most likely our expectations for the top line. For our DCF to be in-line with the current price, we have to assume that TTWO market share completely plateaus after 2021. We’d also need to take our operating margin assumptions down by 300 bps to 30%, which would be lower than EA and ATVI are already earning today. This all seems unlikely given TTWO has increased share by nearly two-fold in the last five years, the development pipeline is twice as large as it was five years ago, they are actively pursuing M&A, and the core titles have lots of organic momentum. We are comfortable taking the over on this.

What would the 10th Man say?

We could be underestimating revenue growth, particularly inorganic growth. Management is clearly keen on pursuing M&A, and it’s within the realm of possibility that within the next decade they find a diamond in the rough at an excellent price. ATVI acquired King in 2015 for 6.0x EBITDA. If TTWO struck out and found a mobile acquisition with a $4 bln price tag for even 10x EBITDA, mobile revenue could grow by $1.2 bln at a 35% EBITDA margin. Long-term growth from acquired franchises would exacerbate this revenue upside. This would be a significantly better use of cash than systematic buybacks, and would drive much more upside than we even contemplate in the bull case. Still, valuations for mobile developers have clearly gone up, and large strategic M&A targets aren’t waiting for TTWO on a platter. If the bull case was a 90th percentile outcome, we think this would be much further out on the right tail of the distribution.

On the flipside, if we prove to be wrong to the downside in the base case, we suspect it would be because organic revenue growth falls short of our expectations. A 10th (wo)man would probably say we’re too optimistic about console and PC market share. Maybe live-service ARPU is closer to plateauing than we assume. Maybe EA makes a comeback with NBA Live. If TTWO drops the ball, even once, on a core franchise like GTA, it would cripple our revenue outlook. Brands take forever to build, and a second to destroy. In the case of GTA or RDR, where development cycles are close to a decade long, one bad release would hard to recover from. Cyberpunk is an example of a AAA game flopping HARD, and it was financially devastating for CD Projekt Red. This is the downside of a concentrated portfolio. TTWO has such a good track record at delivering high-quality content that this has to be an extremely low-probability event, but it’s a risk to be cognizant of nevertheless.