Total Specific Solutions (TSS) was an operating group of Constellation Software (CSU:TSX) that was spun out in early-2020. The newly formed entity is called Topicus (TOI:TSXV). This deep-dive is essentially a sequel to the CSU piece, and for the sake of brevity, I reference the CSU deep-dive frequently. Given the many similarities between the two businesses, I encourage you to read that piece first (link).

As always, I welcome questions, feedback, and criticisms of the views and analysis presented here. I can be reached at the10thmanbb@gmail.com.

Full disclaimer: I’m currently a TOI shareholder.

Investment Thesis

TOI is effectively a carbon copy of CSU, with a nearly identical decentralized organizational structure, decentralized M&A process, sticky customers, and strong reputation as a perpetual owner of VMS businesses. Even the board of directors has meaningful overlap. As such, TOI should also benefit from low customer churn and sustainably high incremental ROIC on acquisitions. Despite these similarities, four obvious differences stand out:

TOI is roughly the size of a 2010-vintage CSU. They’ve reset the clock on M&A, and it should be much easier for TOI to scale the number of acquisitions they complete in a year by five-fold than it will be for CSU today. All else equal, inorganic growth should be easier to come by.

The directors appointed by CSU (six of the ten) are more likely to approve of large acquisitions (by lowering hurdle rates) than they were at CSU from 2010-2020. This should mean fewer distributions to shareholders over the next decade, and higher growth.

The vast majority of TOI’s revenue does and will come from Europe over the foreseeable future, and it’s my view that Europe has: a significantly more fragmented VMS market, with many local market leaders; less private equity dollars chasing acquisitions, particularly on continental Europe; and, a culture that makes VMS sellers more likely to partner with perpetual owners like TOI than transient owners like private equity. This should help scale M&A faster over the next decade than CSU was able to do from 2010-2020.

Topicus.com achieved historical organic growth >10% vs. organic growth at CSU and TSS of <2.0%. The CEO of Topicus.com will become the CEO of TOI, and I suspect he will increase the emphasis on organic growth at the other TOI Operating Groups. As a result, TOI is likely to have higher organic spending, and the data from Topicus.com shows that this organic capital earns a ROIC that’s fairly close to that of acquisitions.

All told, the ingredients are there to bake a cake that ends up being just as good, if not better, than the one CSU cooked up over the last decade. In my view, the current price of €45/share implies that the market is significantly discounting TOI’s inherited competitive advantages and the positive idiosyncratic nuances highlighted above. My DCF-driven base case assumes fair value of €65/share, with risk skewed to the upside. As a gut check, TOI trades a 45x 2021 FCF. If you had purchased CSU at 45x FCF in 2010, you would have earned an 18% annual return over the last eleven years.

Introduction to TOI

A mini-CSU is formed (1998-2012)

Rinse Strikwerda started an IT service company in the Netherlands in 1984, and took it public as the TAS Group in 1998. The IPO netted him something close to €100 mln. At about the same time that Mark Leonard was getting Constellation Software off the ground some 6,000 kms away, Rinse decided to take that new wealth and start a family office. His daugther, Tjitske Strikwerda, and husband, Robin van Poelje, were tasked with managing the family capital. Strikwerda Investments was born.

Despite some initial investments in infrastructure, food, and aviation, the family’s background in technology ultimately led to a few large platform investments in various software categories. One of these platforms was Total Specific Solutions (TSS). The goal with TSS was to create a decentralized serial acquirer of vertical market software (VMS) businesses in the Netherlands. As a family office with permanent capital and a decentralized philosophy, part of the pitch to VMS targets was probably something like:

Hey, sell your business to us. You and your employees will have a permanent home. You can keep running your business, and have total autonomy as a stand-alone entity within the TSS umbrella. We’ll provide you with access to capital, should you need it. You can utilize shared administrative functions like HR, accounting, and legal, so that you can focus on what you do best: providing customers with great products.

From 2006 to 2012, TSS completed eight VMS acquisitions. Revenue grew from €67 mln in 2008 to €201 mln by 2012 (31% CAGR), making TSS the largest VMS business in the “Benelux” (Belgium, Netherlands, and Luxemburg - I had to google that too). Roughly 85% of this revenue came from local government, healthcare, and financial services customers. What’s more fascinating is that TSS businesses emphasized a software development process that leaned heavily on client input, leading to mass customization. These customized products created very sticky customers right from the start.

Becoming part of the CSU family (2013-2020)

After a decade of helping run the Strikwerda family office, Robin took over as full-time CEO of TSS in 2010. When CSU came knocking in 2013, the family agreed to sell TSS so long as they could retain a 33% minority interest and Robin could remain as CEO. CSU agreed.

TSS had many of the features that CSU finds attractive in VMS targets: a dominant position in certain Dutch verticals, customized products, successful implementation of a decentralized structure, a management team that thinks very long-term, and great local reputation as a home for future VMS prospects. Despite this alignment, there were some elements of the TSS leadership team that didn’t embrace the CSU culture, and three senior people at TSS got let go within one year of the acquisition. From 2012 to 2014, revenue at TSS was more-or-less flat, and I’m fairly certain that not a single acquisition was executed in 2013/2014 as those integration pains were remedied.

By 2015, the team and processes were in place to kick the VMS M&A machine into sixth gear. Exhibit A shows the number of acquisitions completed by TSS under both owners, and CSU’s Midas touch jumps off the page. It seems fair to credit Robin and CSU in equal proportions; having access to processes and resources is one thing, but executing well is another entirely. In any event, under the tutelage of the mothership, TSS increased the number of software verticals from basically 5 primary ones in 2012 to 17 at last count. I don’t have excellent historical data, but it’s also clear that TSS has been aggressively expanding outside of the Netherlands. Revenue from the Netherlands was 62% of the total in 2020, down from 80% in 2018. As a CSU operating group, TSS grew revenue at nearly 20%/year, and EBITDA margins from 18% to 33%. Quite the success story.

Leaving the nest, sort of (2021+)

In 2020, CSU announced that they would be spinning TSS out as a separate publicly listed entity, in conjunction with a large acquisition of another Netherlands-based VMS business called Topicus.com. The new entity would take the Topicus name, and trade on the TSX Venture under the ticker TOI.

The TOI structure is convoluted, but once all preferred and exchangeable units are converted, it will look something like Exhibit B. Much like CSU, the TOI head office is a relatively thin management layer that oversees three Operating Groups (OGs). TSS Blue serves customers in the private sector, and the other two are self-explanatory. Each OG manages dozens of Business Units (BUs), which have autonomy to make customer and product decisions, but typically defer capital allocation decisions to the OG or TOI head office. It’s expected that the majority of free cash flow gets redeployed through acquisitions, which is an important part of the DNA at both TSS and Topicus. In many ways, this reminds me of a 2010-vintage CSU.

The Joday Group is an investment vehicle utilized by the Strikwerka family office, and owns 30.3% of the fully diluted shares in TOI. Their equity interest in TOI is similar to the equity interest they held in TSS while it was still a CSU OG. Ijssel represents the sellers of Topicus, and owns 9% of the fully diluted shares. This implies that the sellers retained ~25% of their equity value on the sale. Both Joday and Ijssel have the right to appoint two of the ten directors on the TOI board (four appointments in total) so long as they each retain a 5% stake in TOI.

In addition to the 30.35% interest of fully-diluted shares, CSU owns 1 Super Voting Share that grants them 50.1% of the votes. So long as CSU retains a 15% interest in TOI, they have the right to appoint the remaining six directors on the board.

As public shareholders, all of our governance trust is placed in the hands of CSU, Joday, and Ijssel. Normally, this would bother me (“hey, where’s my voice”), but in this instance it doesn’t at all. If you read my CSU deep-dive, you’ll know that I think Mark Leonard & crew are some of the best business managers and capital allocators in the world. I trust them to represent me. The partners at Joday share many of the same qualities. In an interview last year, Tjitske Strikwerda was asked where she sees the family office in five years. She responded:

“We don’t think in terms of five years, we think in terms of generations… Our focus is on building companies that are able to reinvest their cash flow in new growth opportunities and thus achieve a leadership position in their market segment. We call them compounders. Building such a compounder is difficult, it is time consuming. But we have plenty of time.“

Who knew she was a compounder gal? In my view, it’s great to have partners (including Robin) with this long-term mindset guiding company decisions.

The CSU and Joday partnership has worked out great so far, and I think Ijssel/Topicus will also bring a lot value to the table. To understand this better, it’s worth taking a deeper look at the Topicus business and what they’ve achieved.

Topicus

Topicus was founded by three partners in 1998, who have since built a VMS business in the Netherlands around three platforms: Education, Finance, and Healthcare. Each platform has two or three primary verticals, and much like TSS, they tend to be the market leader in those niches. For example:

They own a company called ParnasSys within the Education platform, which develops software used by administrators, teachers, students, and parents in nearly 75% of primary schools in the Netherlands.

More than 80% of mortgages in the Netherlands are either originated, serviced, or advised by Topicus-owned Findesk or FORCE products.

The SourceIT platform facilitates all of the nation-wide population screening for breast, cervical, and colon cancer, in addition to prenatal and newborn screening. As an aside, they’ve done such an excellent job on SourceIT that a quality watchdog in the Netherlands recommended them to a hospital in Brazil that’s trying to create a similar quality national program (link). Talk about a happy customer.

There are many other similarities between Topicus and TSS aside from the focus on being the dominant player in a niche: they both have a decentralized structure, they both pursue M&A, and most products are customized and mission-critical to their customers. I swear, at first glance you could mistake these for nearly identical businesses.

That being said, there is one glaring difference between Topicus and their new partners: an emphasis on organic growth. I was able to gather some historical financial information from company.info.nl (credit to @Read_cap for flagging) for both TSS and Topicus, and compared proportional M&A and organic spending between CSU, TSS, and Topicus (Exhibit C). Topicus spends proportionally much less on M&A, but 6.0x more on organic growth than both CSU and TSS. As a smaller business that leans heavily on organic growth, it’s unsurprising that EBITDA margins are lower (9% vs. 30% at TSS). If I count some of the expensed R&D/S&M as “growth capital”, it’s easier to compare apples-to-apples growth spending. What I find is that Topicus spends about the same as TSS to achieve similar top-line growth. It’s therefore reasonable to assume that organic growth spending at Topicus is nearly as profitable as the M&A engine that CSU/TSS have perfected.

The organic growth culture at Topicus is fascinating: they host an annual conference called TopiConf to share best practices; they have a competition called Race 2 Make It Real where multiple teams race to turn ideas into products; and, they host an annual Hackathon where developers pitch new ideas, and the best ideas get funded. Unlike CSU and TSS, Topicus more frequently builds new VMS businesses from scratch like Junko, and acquires VMS IP with the intention of integrating it into existing platforms. A group of Topicans (a self-inflicted nickname) went so far as to build their own in-house brewery to provide Topicus Gifikker beer to all employees. This is clearly an environment that fosters and encourages experimentation.

The CEO of Topicus, Daan Dijkhuizen, is taking over the role as CEO of TOI, and I imagine he’ll help emphasize organic growth at both of the TSS Operating Groups more than it has been in the past. This leads me to believe that organic growth at TOI will be sustainably higher than at CSU, without meaningfully impacting incremental ROIC.

On the flipside, Topicus stands to gain from the CSU/TSS M&A playbook. Exhibit A shows what happened at TSS after joining CSU, and I expect we’ll see something similar happen to the Topicus Operating Group. I also suspect that EBITDA margins at Topicus, which stand at just 9%, will expand under the TOI umbrella, particularly as the OG scales. After all, this is exactly what happened at TSS from 2013-2020.

All told, I think the Ijssel investors have created something unique that compliments TSS nicely: 1 + 1 = 3.

European VMS

Fragmented Market

I read a Tegus transcript recently where a Shopify employee talks about the level of complexity involved when translating a user interface (UI) into other languages. Let’s say a small VMS company originally creates a product in English, and then looks to expand the offering in Japan. First, they need to translate all the words that users see into Japanese. But those Japanese characters take up a different space than English characters, so the UI needs to be reconfigured or risk looking horrible. Every time there is a product update, or new feature, somebody needs to translate and reconfigure the UI for every additional language that the software supports. As the UI grows in complexity and number of languages, the time required to manage the UI increases exponentially. Without scale, the unit cost of R&D can increase a lot.

As I think about European VMS, the same problem applies. And it’s not just language. Every country has different regulations, payment systems, and other idiosyncrasies within a given vertical. This makes it harder for a Dutch VMS business to organically expand into Spain than it is for a VMS business in Colorado to expand into California. As a result, it appears that the European VMS market is significantly more fragmented than North America, with many local market leaders. Multiple channel checks help confirm this view. This means that there are probably more VMS acquisition targets in Europe that “have dominant share in a vertical”, and helps explain why TSS made up just 14% of CSU’s 2020 revenue, but 20% of their total acquisitions. It also helps explain why organic growth at TSS and Topicus almost exclusively came from the Netherlands and immediate vicinity.

As TOI increasingly focuses on acquisitions in other countries, they are bound to acquire a suite of VMS businesses that have products in nearly identical verticals but little overlap in customers. If Daan Dijkhuizen successfully rolls out events like the TopiConf to the entire TOI organization, there will be lots of opportunities for VMS businesses in similar verticals but different geographies to share best practices. In the fullness of time, employees from one VMS business might also move to a sister company in another country. As this happens, it seems inevitable that products and processes improve faster than the products and processes at smaller local competitors, which will improve TOI’s competitive position and should lead to lower customer churn and an increase in market share.

Private Market Competition

Much like CSU, a core part of the TOI strategy is to acquire VMS businesses. As a result, they will frequently be competing with private equity buyers, if not directly, then for the sellers mind-share.

It’s difficult to get private equity AUM data for firms that specifically target the vertical market software space, but McKinsey (through Preqin) does aggregate total private equity AUM by sub-category and region. The data shown in Exhibit D tells me that there are fewer private equity dollars chasing deals in Europe than North America, even if I adjust for relative GDP. What’s also interesting is that the pool of private equity dollars has grown much faster in North America than Europe, in large part because of a difference in new fundraising (not growth in value of assets). A significant portion of European private equity AUM comes from the United Kingdom, which means even fewer dollars chasing deals in continental Europe (where TOI shops). All else equal, it appears likely that competition to acquire VMS businesses is probably weaker in continental Europe than North America, which leads me to believe that TOI might have an even easier time scaling M&A than CSU did. There are some potential flaws with looking at AUM as a percentage of GDP and then assuming fewer dollars are chasing VMS deals in Europe, but the margin of error is wide enough to provide me some comfort for this hypothesis.

In addition, Crozdesk published a report in 2018 that evaluated ~20,000 software companies around the world. They found that Europe was home to 22% of software companies in their universe, but received only 5% of global funding (governments, family offices, venture capital, etc.), whereas North America was home to 63% of companies in the universe but received 89% of global funding. What this tells me is some combination of A) European software businesses are much smaller than North American counterparts, and/or B) each business receives much less growth capital. Crozdesk also broke out a relative growth score per region, which is a function of age, total capital raised, and employee growth. No matter how I look at the data, it’s clear that European software companies (in aggregate) receive less capital and grow slower than those in North America.

What does this mean for TOI? Two things. First, I think this supports my thesis that competition to acquire VMS businesses is lower in Europe than North America, so TOI should be able to scale M&A more easily than CSU did. Second, I suspect there are ample opportunities to deploy organic capital in a relatively capital-starved market, which should help support higher organic growth than CSU.

Culture

One recurring theme I’ve noticed while writing this deep dive is a wide-spread culture of conservatism in Europe.

The University of St. Gallen and Ernst & Young maintain an index of the 500 largest family-owned firms in the world (both public and private). Europe dominates that list, regardless of whether you measure proportional constituents or proportional revenue (Exhibit F). Adjusting for GDP or market capitalization of public companies only exacerbates the contrast between Europe and the RoW. @MrJonasDanner flagged this report (in German) on the history of family businesses in Germany and the United States, and while they explore many reasons for the differences in family ownership, one section in particular caught my attention. In Germany, there is a “culture base on continuity and quality, balance and family ties”, where preserving legacy and tradition is more important than in the United States. This seems to be true in other European countries as well. If this is right, it might mean that European VMS owners would be more compelled than North American VMS owners to sell their business to a perpetual owner like TOI than to a private equity firm that will turn around and sell the business again in 7+ years. All else equal, I suspect that this will help TOI scale M&A more easily than CSU. Both the TSS and Topicus deals imply as much.

Gut checking these assumptions

If Europe truly is more fragmented, competition is less fierce, and CSU’s reputation/culture is a stronger advantage, then you’d expect to see historical growth from Europe be disproportionately high at CSU. Exhibit G shows that this was the case, with European contributions growing significantly over the last 15 years. Even if we look at top-line growth after the TSS acquisition, it’s clear that European revenue growth (probably both organic and M&A) was much higher than North America. I think this trend provides some supports for my various hypothesis, or, at the very least, doesn’t disprove them.

Competitive Advantages

I think TOI benefits from the same competitive advantages as CSU (see the CSU deep dive for a more detailed explanation of each):

High switching costs: customized mission-critical VMS products that represent a small share of the customer wallet make it difficult and/or annoying for customers to justify switching vendors. This leads to low customer churn, better pricing power, and high return organic growth opportunities. A substantial portion of TOI’s revenue also comes from customers in the public sector, which should have much lower churn than the private sector.

Decentralized operating structure: this helps to maintain an entrepreneurial culture that makes it easier to attract and retain talented people and avoid bureaucracy creep. It results in higher customer loyalty, continuously improving products, and lower overhead, all of which help with low customer churn and organic growth.

Decentralized M&A: this allows TOI to scale the number of transactions they complete in a year, while keeping acquisition size low. The data shows that small acquisitions generate better returns than large acquisitions.

Reputation and culture: a great reputation makes it easier to source VMS acquisition targets while avoiding competitive auctions. I suspect it also allows TOI to acquire businesses for less than other bidders, even in auctions. For example, the scuttlebutt on Topicus suggests that CSU (TOI) wasn’t the highest bidder. Topicus chose to join CSU (TOI) because of their culture and reputation as perpetual owners that provide both autonomy and resources to the target post-close.

Financial Position

CSU, Joday, and Ijssel all received convertible preferred shares as part of the TOI IPO. These units pay the holders a 5% dividend until converted, which amounts to ~€60 mln per annum. A forced conversion takes place when the value of TOI shares exceeds the Target Price by 25%, which works out to roughly €24 per Subordinate Voting Share. At present, TOI shares are trading at a 130% premium to the conversion price. If they remain above that conversion price by the end of 2021, the preferred units will get converted in mid-2022. Once converted, there will be 130 million Subordinate Voting Shares outstanding, and the annual preferred dividend will go to zero. Until converted, the annual preferred dividend sucks up ~30% of TOI’s cash flow from operations.

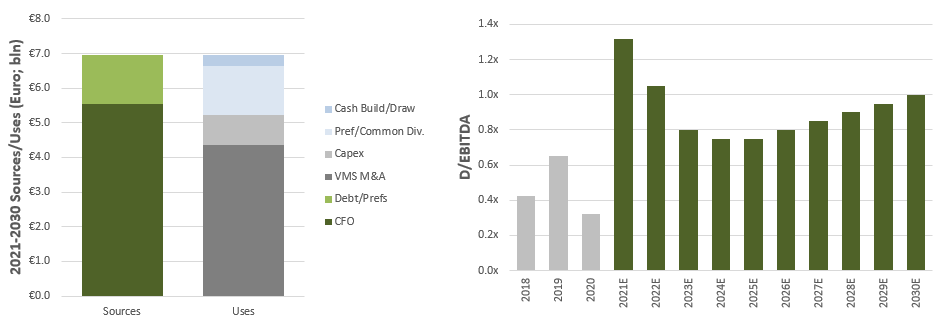

Prior to the spin-out, TSS had ND/EBITDA of 0.3x. In 1Q20, TOI will draw down €200 mln on their credit facility to cover a special dividend to the previous TSS owners and part of the Topicus acquisition cost. This will likely take 2021 ND/EBITDA to 1.3x. I expect that sufficient opportunities will exist to pursue a combination of organic growth and M&A that TOI will end up terming out any debt on the credit facility (rather than paying it out with CFO), particularly in light of the preferred dividends being paid over the next 18 months. This means that TOI will likely maintain higher leverage than CSU over the medium term. As the business grows, I expect natural deleveraging to occur (lower ND/EBITDA). With all of the capital deployment opportunities available to TOI, I also think it’s incredibly unlikely that they pay any type of common dividends until closer to 2030.

Management & Governance

As discussed earlier, 100% of directors on the board are appointed by either CSU, Joday, or Ijssel. Unsurprisingly, each director appointed by CSU is either an executive or director of CSU (including Mark Leonard). Joday elected Robin van Poelje (who is also the Chairman), and the TSS Operating Group CEO Han Knooren; both of these guys have been with TSS for a decade, and are well acquainted with the CSU team and processes. Ijssel elected the CEO and CFO of Topicus.com (the acquired business). For a company of this size, TOI has an all-star line-up of directors with a wealth of relevant experience in this business. You couldn’t ask for a better board.

One thing I find particularly interesting is that TOI is about the size of CSU in 2010. They get to reset the clock on M&A, but get the benefit of the cumulative knowledge and experience that accrued at CSU over the last decade. There are very few things that CSU did poorly from 2010 to 2020, but one obvious sub-optimal decision was refusing to lower hurdle rates to pursue large VMS businesses. The consequence of holding firm on hurdle rates was that CSU ended up with a growing cash balance and paid multiple special dividends, instead of deploying more capital at returns that would have still exceeded their cost of capital. In my view, the CSU board, including Mark, has reflected on these decisions and changed their mind about the optimal path forward. As a result, I expect the TOI board to push for more M&A over the next decade, including large deals, than CSU did from 2010-2020. This is a nuance that I think the market is missing today.

A unique decision that deserved more attention in the CSU deep-dive is that the CSU board does not issue stock from treasury to anybody. Instead, they require that a portion of all a-tax bonuses for executives and regular employees above some threshold is used to purchase CSU stock in the open market. In addition, 100% of the a-tax fees paid to each director on the board must also be used to purchase shares in the open market. For directors, executives, and employees, these shares are held in escrow for a minimum average period of four years. This has saved long-term CSU shareholders from dilution over time, which is great considering CSU stock has arguably been undervalued since the IPO in 2006. It’s therefore no surprise that the same policy applies at TOI, which I think is a great thing given my view that the stock trades below fair value. This is a commendable board decision that doesn’t get nearly enough attention.

Unlike CSU, where executives and the board own more than US$1.5 bln of equity (after decades of accumulation), insiders at TOI own just ~€60 mln - to start. In most instances, the TOI equity represents a fraction of an executive or directors net worth, particularly for those directors also on the CSU board. For example, Mark, Stephen, Robin, Bernard, and Jamal, all have 10x more capital in CSU than TOI. I can understand why some investors would perceive this poorly, but I don’t see it as an issue. TOI is still important to CSU given their large equity interest, and Daan Dijkhuizen, the new CEO primarily responsible for executing on strategy, should have a significant portion of his wealth tied exclusively to TOI. In addition, insider ownership should grow significantly given that all board fees ultimately get used to purchase TOI stock, and a significant portion of executive compensation (75% of a-tax bonus) also has to be invested in TOI shares. Those bonuses are tied to a combination of excess ROIC and net revenue growth.

All told, I think TOI has a great board and management team, and that they are properly aligned with public shareholders.

Valuation & Scenarios

Organic Growth

From 2018-2020, organic growth at TSS averaged 1.7%, and I estimate that organic growth at Topicus was somewhere in the low-teens range. If nothing else changes, we know that organic growth for TOI in 2021 should be 3.5-4.0% (the weighted average of both entities). With Daan taking over the CEO role, I expect that the emphasis on organic growth at the TSS Operating Groups will increase over the next five years. At the same time, organic growth at Topicus probably falls slightly as the business grows and more human capital is deployed on acquisitions. In the base case, I assume that the net effect is organic growth that increases slightly through 2025 and slows down thereafter. High switching costs and a decentralized organizational structure should help to keep churn low while TOI builds out new software.

It’s helpful to visualize the base case versus historical and forecast organic growth at CSU (Exhibit H). The forecasted excess organic growth over CSU adds ~€5/share to my estimate of fair value. If I assume that 15-20% of expensed R&D and S&M is actually growth capital, then this implies that organic spending generates a 16-18% incremental ROIC.

M&A

CSU was able to ramp up acquisitions from <20/year in 2010 to nearly 100 by 2020. I see no reason why TSS couldn’t ramp up acquisitions from <20 in 2020 to 100 by 2030, and do so more linearly than CSU, largely because: the same decentralized M&A process exists, the market is more fragmented, competition from private equity appears less fierce in Europe, reputation is potentially a greater advantage in Europe, and the board of directors is now more likely to approve larger deals (albeit at lower ROIC). Exhibit I shows my base case expectations for acquisitions per year, average deal size, and average acquisition multiples. Under these assumptions, TOI spends 80% of their operating cash flow on M&A through the forecast period versus 65% for CSU over the last decade.

In Exhibit J I’ve plotted the relationship between historical deal size and acquisition multiples for CSU and TOI, and my base case forecast adheres to that relationship. Notably, I assume that TOI does another large acquisition (something like Topicus.com), at some point in the forecast period (arbitrarily 2026), which explains the second blue dot at 1.6x EV/Sales.

Margins

In 2012, EBITDA margins at TSS were 18%. CSU acquired the business in late-2013 and by 2015 EBITDA margins reached 27%. In 2020 they hit 33%. I only have detailed expense data for 2018-2020, but it shows that expense items that primarily reside within a BU like R&D, S&M and G&A either stayed flat or increased (relative to revenue), while shared expenses like Professional Services decreased significantly as a percentage of revenue. This is exactly what we’ve seen at CSU as they’ve scaled the business through acquisitions, but allowed BU’s to operate autonomously. I illustrate this in Exhibit K.

If TSS remained a totally stand-alone entity, I’d expect that shared expenses would continue to shrink proportionally faster than BU expenses rise, which would lead to continued margin expansion for many years, albeit with diminishing marginal increases. But TSS is no longer a stand-alone entity after the acquisition of Topicus, which had EBITDA margins of just 9% last year. Over the next two or three years, I suspect Topicus margins will rise significantly because of cost-synergies and the benefits of inorganically scaling the business (just like TSS). However, higher organic growth at Topicus translates to structurally higher R&D/S&M. In addition, a potentially growing emphasis on organic growth at the TSS Operating Groups should drive higher R&D/S&M spending there as well. As a result, the benefits of scale should largely be offset by higher expensed “growth capital” so long as organic growth stays high. In the base case, I therefore assume that EBITDA margins drop in 2021 and stay relatively flat until organic growth slows down (Exhibit L). By the terminal year, I expect margins to be only slightly higher than they were in 2020.

Funding & Balance Sheet

I expect the vast majority of operating cash flow to be spent on acquisitions and organic growth over the next decade. In the base case, TOI wouldn’t need to rely on external capital to fund this growth, which is why D/EBITDA falls significantly over the next few years (even as absolute debt stays more-or-less flat). I have no strong view on where leverage will shake out over the medium term, but it seems inevitable that TOI ultimately utilizes the balance sheet for either A) distributions to equity holders, or B) new initiatives, much like CSU 2.0. I suspect all directors appointed by Joday and Ijssel will favor distributions to equity holders versus new untested initiatives, while the CSU directors are probably evenly split, which is why my base case favors distributions. If I’m wrong, and TOI finds new ways (outside of VMS) to deploy capital in excess of their cost of capital, my estimate of fair value would increase significantly (see scenario analysis below).

Tying it all together/Outputs

In the base case, revenue and EPS grow at 24.5% and 26.5% through 2030 (versus 20% and 30% at CSU from 2010-2020). TOI deploys effectively all of their FCF on organic growth and acquisitions, but at a lower ROIC than CSU, so total ROIC stays in the mid-20% range.

The DCF model suggests fair value in the base case is €65/share, which represents >40% upside to the current price of €45/share. A snapshot of the model is shown below, but the full DCF with all my assumptions can be found above.

My bear and bull case scenarios are meant to represent the 10th and 90th percentile outcomes, and Exhibit P shows how my assumptions change to arrive at each.

I’m growing fond of visualizing my scenarios versus the current price in a hypothetically normal distribution (Exhibit Q). I’ve also included what I think the base business is worth if TOI ceased all acquisitions post-2021.

I clearly believe that the risk-reward on TOI is fantastic, which begs the question: what is the market missing? It’s difficult to answer this with any confidence for a small-cap Canadian stock with weak sell-side coverage and effectively nil history as a public company. That being said, to back into the current price I have to assume that:

TOI deploys slightly less of their CFO on acquisitions than CSU did from 2010-2030, and earns worse incremental ROIC on those deals, despite well established culture/processes, a stacked board, and favorable backdrop in Europe;

Organic growth is more-or-less in-line with my long-term CSU assumption, despite the obvious benefits from the Topicus.com acquisition; and,

EBITDA margins largely remain unchanged from 2021, despite the scale benefits of a growing organization.

In my view, there is sufficient evidence to suggest that expectations are too punitive.

Lastly, I don’t normally like to lean on multiples as a primary valuation measure, but they can often prove useful as a comparative tool. With that said, I note that TOI trades at ~45x 2021 FCF (on fully diluted shares). Back in 2010, if you had purchased CSU at 45x FCF, you would have earned an astounding 18%/year over the proceeding 11 years. At 95x FCF, a CSU investor in 2010 would have earned 10%/year for more than a decade. If you ignored all the rest of my analysis, but believe TOI will follow even remotely in CSU’s footsteps, this indicates that the risk-reward on TOI is fairly compelling.

What would the 10th (wo)man say?

One thing I’ll admit to struggling with is how to think about terminal value. My assumptions imply an exist P/E ratio of 21.6x (3.5% terminal growth and 25% ROIC), but CSU still trades at >30x. My base case would be 50% higher if I used 30x instead of 21.6x. The reason I don’t is because ten years is a long time, and the global VMS market is likely to be more concentrated by 2030 than it is today, which makes the outlook for TOI in 2030 less compelling than the outlook for CSU in 2020. Of course, the 10th (wo)man would say that the VMS market is growing quickly and there will still be room for lots of big serial acquirers. They might also say that TOI could pursue other businesses in conjunction with VMS, much like CSU is doing today. These are all valid points, and if I’m really wrong to the upside, I suspect it’s because of this.

On the flipside, the 10th (wo)man might say that there is only one Mark Leonard. As good as Daan Dijkhuizen might be, he still has to fill the shoes of a legend. What if CSU ends up selling their stake in TOI, and the board loses all of that CSU experience? What if Joday also sells their stake and TOI loses Robin? It’s feasible that culture and processes are disrupted to the point that decentralization fails and acquisitions become harder to execute on at good returns. That being said, given the long-term ownership mindset of both CSU and Joday, and the fact that CSU almost certainly doesn’t need the capital, I think this is unlikely.