Investing in oil and gas producers is challenging in large part because they are exposed to both volume and price of the underlying commodities, and price is notoriously difficult to predict - particularly as a generalist. At the same time, I’ve always had an affinity for energy infrastructure – the businesses that process and transport oil and gas from producing regions to consuming regions. These businesses often have no direct price exposure, and instead clip a fee for moving molecules. Where price tends to be volatile and unpredictable, volume is surprisingly stable (Exhibit A).

When I first wrote about TC Energy (TRP 0.00%↑) in 2020 (link), what I found most attractive was that they had de minimis commodity price exposure, and that most of their assets were heavily contracted. In my view, those assets are clearly considered critical infrastructure – if they all shut down tomorrow, there would be an energy crisis in North America. That view hasn’t changed, but I think it’s worth a quick recap on what they own and why this portfolio is so attractive.

Exhibit B shows a breakdown of historical EBITDA by segment, and the first thing to notice is that 77% of TRP’s EBITDA now comes from natural gas pipelines, up from ~50% a decade ago. This pipeline network serves some of the largest producing and consuming regions in North America and touches more than 20% of all the gas produced on the continent – that is wild to think about.

What I love about their natural gas network is that it’s largely regulated, which means they generate regulated returns. In Canada, that means TRP earns a 10-15% ROE depending on the asset, but it also means that interest expense is a flow-through item. When rates increase, TRP can pass that cost through to their customers (there is a lag, and it’s not always that simple, but in theory that’s how it works). In the U.S., TRP’s pipes are regulated by FERC and a similar dynamic is at play, although TRP can also negotiate tolls under long-term take-or-pay contracts (no volume or price risk) when they deploy new capital to build pipes or expand existing networks. Those incremental negotiated rates often generate a ROE that exceeds the regulated return. I get that these aren’t gangbusters returns, but they do lead to incredibly consistent and predictable free cash flow generation regardless of what’s happening in the economy or energy markets. You can almost think about these assets in isolation as bonds.

It is incredibly hard to build new energy infrastructure today, particularly long-haul pipelines that require new right of ways. It would be less daunting to fit an F150 into an apple than it would be undertake a new pipeline project to transport gas from Canada to Texas. I’ll circle back to that idea in a minute, but the readthrough is that the incumbent owners of large pipeline networks should face little-to-no competition from new entrants. That, in turn, makes those existing pipeline networks more valuable than they would be otherwise, and gives owners like TRP some leverage to negotiate higher ROEs on expansion projects (that utilize existing corridors and infrastructure) than what they might otherwise generate from regulated returns.

So, the only real risk it that natural gas production on the continent declines, and I’m not very concerned about that over the next few decades. To explain that view in detail would require another 20-page piece (although you can find a lot my thinking in the original TRP post), but to cut a long story short, here is a quick breakdown of some themes that support gas production in North America:

Coal-to-gas switching: electricity generation is the largest source of gas demand in North America, and coal still represents 20-25% of the generation stack. The average natural gas power plant produces ~58% fewer kg’s of CO2 per kWh of electricity than the average coal power plant, so there are clear benefits of switching from coal to gas. The levelized cost of energy (LCOE) is also often lower for gas than coal, in part because we found cheap gas in America and in part because of carbon pricing. Whatever the reason, coal-to-gas switching has been a huge driver of gas demand over the last 15+ years, and I see no reason that’ll stop given how much share coal still has.

Lack of economically viable substitutes: This matters for most natural gas use cases, but in the power market you can’t switch out gas/coal for wind and solar because of base load requirements. You could sub out gas/coal for nuclear or hydro, but hydro resources are pretty tapped and there is a clear aversion to building new nuclear plants globally (if anything, existing facilities are getting shut down). Barring some enormous step change in battery economics or hydrogen, there just isn’t an alternative to gas today if society wants to shut down coal plants. The same goes for other use cases, like gas used for residential/commercial heating or industrial processes. I’ve seen some arguments like electric heat pumps could replace natural gas furnaces, but all that would do is increase electricity demand (inefficiently, I might add), and change where the gas is consumed.

Liquified Natural Gas (LNG) exports: natural gas is significantly cheaper in North America than the RoW, but historically there had been very little LNG export capacity out of North America to capture that “arb” - that’s changing. As export capacity ramps up, there should be significant incremental demand for North American gas.

If I’m right that gas production won’t decline any time soon, and incumbents are well positioned to continue moving molecules without serious competition, then it follows that investors should have pretty good visibility to stable FCF from these assets. And to the extent that there is some growth in production/demand, I think this network is very well positioned to expand capacity via small low-risk capital projects, which could drive some low-to-mid-single-digit growth. I’d also add that one of the potential substitutes for natural gas, like hydrogen, would very likely utilize existing natural gas infrastructure. So, I don’t even view that as a risk to some of these energy infrastructure businesses - if anything, it could lead to more investment opportunities.

Like the gas pipeline business, the Liquids Pipelines business is reasonably predictable – most of that EBITDA comes from the Keystone pipeline, and roughly 90% of Keystone’s EBITDA is secured by take-or-pay contracts with a weighted-average remaining contract length of 8 years. Even when those contracts roll, most of the shipment volume out of Western Canada is from low decline oilsands assets that should keep producing for decades. I’m reasonably confident there will never be a new oil pipeline out of Canada, which means Keystone should remain heavily utilized even without contracts. Relative to competing pipelines like the Enbridge Mainline system, Keystone is also a young asset, which means it should be one of the last to get decommissioned.

Finally, TRP’s Power & Storage business consists of some cogeneration capacity and an equity interest in the Bruce Power nuclear facility in Ontario. Bruce is the crown jewel here, and it supplies ~30% of Ontario’s electricity. TRP is going through a refurbishment/expansion project that will extend the useful life on Bruce Power through the 2060’s – they are likely to spend an additional $6.0bn on these projects over the next decade. What’s great about Bruce Power is that it’s largely contracted such that TRP earns a guaranteed return of and on capital, much like their other regulated assets. Even better is that TRP has no liability for decommissioning or dealing with spent nuclear fuel. Again, investors have a ton of visibility on cash generation out of this growing low-risk asset.

The combination of predictable operating income and largely pass-through interest expense mechanisms means that TRP can run hot on the leverage front. And they have. Exhibit C shows TRP’s historical ND/EBITDA (as calculated through rating-agency eyes), and while they exited 2022 near the high end of their historical range, this business has consistently operated with ~5.0x ND/EBITDA.

Exhibit D shows TRP’s Debt/Cap ratio and differentiates between Debt/Cap prescribed by regulators, and excess Debt/Cap. The ratio prescribed by regulators is the level at which TRP can theoretically flow through 100% of their interest expense to end customers via higher tolls – beyond that TRP is on the hook for eating that incremental interest expense. That’s fine if they are earning a prescribed return on equity greater than their borrowing cost and the cash flow from those assets is stable/predictable.

At first glance you might worry that a rising interest rate environment would erode free cash flow to equity given the excess debt/cap, but even for the interest expense that doesn’t benefit from the flow-through mechanism, TRP is doing fine. Roughly 85% of their debt is fixed rate, and the average remaining term for that debt is ~20 years! They’re basically matching asset/liability duration.

Exhibit E shows how all this translates into ROIC and ROE. While TRPs regulated return on equity is often around 10%, they do build some projects at negotiated rates that are likely a bit better and then juice those returns with a little extra debt. The net result is a return on equity that has consistently met or exceeded that 10% regulatory benchmark – even with the cumulative impact of fumbled projects like Keystone XL and Coastal GasLink (I’ll circle back to this last one in a minute).

In my view, the combination of low-teens equity returns, stable and predictable cash flows, and long-duration fixed-rate leverage is attractive. And if you can acquire that cash flow stream at a reasonable price, I think TRP makes for a good investment. TRP is currently trading at ~11.5x P/E and Exhibit F shows that it hasn’t traded this “cheap” in at least 15 years. The same story plays out for every other heuristic you’d use to quickly assess value.

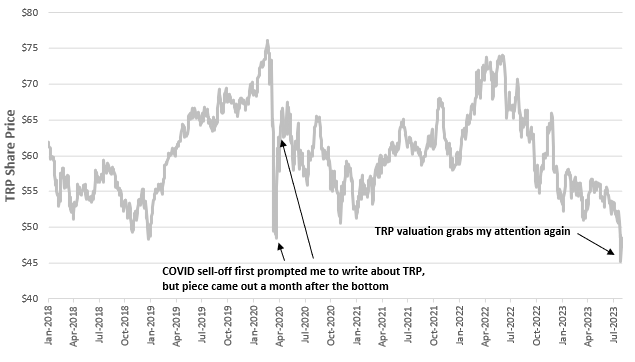

A big reason for that is dismal stock price performance and Exhibit G shows that TRP is down 35% from the peak last summer, and below any point in the last 5+ years. Even if I include dividends, the total shareholder return if you had bought TRP at any point in the last 5+ years is negative or roundable to zero.

So, what happened? Well, higher interest rates certainly don’t help with valuation – most of the return you should expect to generate from an investment in TRP comes via dividends, and higher rates makes that relative value a little less appealing. So, when rates started to increase, TRP’s share price rolled over (Exhibit H). But by itself I don’t think this explains most of the poor performance since last summer. And that brings us to Coastal Gaslink.

Coastal GasLink is a pipeline that TRP is building to transport gas from Western Canada to a new LNG terminal on the coast. They’ve been working on this for years, and even sold down a 65% interest in late-2019. The entire project was initially estimated to cost $6.6bn, but last summer TRP revised the total cost estimate up to $11.2bn. At the time, they communicated that their confidence “in building up our new estimate is high”. Literally four months later they came out and said that they would have to revise the cost estimate higher again because:

“The labor cost and the shortages of skilled labor are intense. We're competing against a very significant project going on in Southern BC. And some of that complexity through the pandemic, contractor underperformance has been challenging. And that underperformance has led to continued disputes. Some of the other challenges that we have had are erosion and sedimentary control measures that are required on this project. We've had over 500 regulatory inspections on the project alone in the past year as a result of these new measures. In addition, in British Columbia this past year, a drought was declared. And unfortunately, that impacted our ability to hydro test on a schedule that we are looking for, for certain sections of our pipe. So as a result, as you saw in our disclosure this morning, we expect a material increase in project costs and our corresponding funding requirements that TC will have to carry.”

In February of this year that new cost estimate came out at $14.5bn, which is a whopping 120% higher than the original cost estimate. TRP is on the hook for $5.4bn of that cost increase, and their 35% share of the equity will remain unchanged. As of 2Q23 they’ve held firm on the $14.5bn estimate, and noted that the project was 91% complete so they had pretty good visibility to the final price tag. Yet they still caveated that if project gets delayed into 2024 it could cost up to $15.7bn. If that were to happen, TRP would probably be stuck funding $6.0+bn of cost overruns that won’t generate a return on or of capital. That’s a significant blow.

Part of the problem with these additional costs is funding. TRP doesn’t have the free cash flow – after dividend payments and other capital spending plans – to fund that extra spend without some combination of incremental debt, equity, or asset sales. Incremental debt obviously stretches ND/EBITDA metrics, and rating agencies would almost certainly downgrade TRP as a result, while I think incremental equity at that size would be very expensive (although they did turn on the DRIP temporarily and raised ~$1.0bn that way). As a result, they’re effectively forced into asset(s) sales. Asset sales can help with deleveraging, but they’d have to sell some significant assets at very high multiples to make the deleveraging math work. Because of that concern, Fitch downgraded TRP from A- to BBB+ in March, and the other rating agencies all moved to “negative outlook”.

Because TRP was a forced seller, last month they agreed to sell a 40% stake in their Columbia gas pipeline businesses for $5.2bn at 10.5x EV/EBITDA. That valuation was clearly lower than what the market was looking for, and TRP sold off as a result. Based on my estimates, it also means that TRP will probably exit 2023 at ~5.2x ND/EBITDA – down from 5.5x at the end of 2022, but still a little higher than the 4.75x target that rating agencies want to see. TRP is still talking about an additional $3.0bn of asset sales, and at a similar valuation to Columbia that probably gets them into a more comfortable leverage range. If they can’t go that route, turning the DRIP back on is another way to close the gap. It might be a little early to declare victory, but I think the worst of the funding concerns are in the rearview mirror at this point.

Despite ultimately navigating these funding challenges, TRP had to issue equity (via the DRIP), accept a Fitch downgrade, risk other rating agency downgrades, and sell a stake in some fantastic assets at less than fantastic prices. All to cover $5+bn in incremental spending that they’ll never get back (literally 10% of the current market cap). So, it’s no wonder the stock has taken a beating.

There is a lesson here, and I think the lesson is that large energy infrastructure projects have a tendency of working out poorly. They either go way over budget like Coastal GasLink or get delayed into oblivion like Keystone XL. And it’s not just TRP that grapples with these issues, it’s most businesses in this industry that take on ambitious and complex multi-billion-dollar projects that are required to clear a near-infinite amount of regulatory and permitting hurdles.

I would be very nervous if TRP was in the process of permitting or constructing another large energy infrastructure project that looked like Coastal GasLink, but I don’t think that’s the case. Outside of Coastal GasLink, TRP is currently working on ~$28bn of secured capital projects with ~$17bn left to spend over the next few years (as of 2Q23). Most of that spend is on bite-sized run-of-the-mill projects – the type of stuff TRP has been successfully doing for decades. The one exception is Southeast Gateway, a gas pipeline in Mexico that still has about $4.0bn of spend left to complete. Fortunately, it looks like TRP learned something from Coastal GasLink and did two things to mitigate the risk of going over budget. First, they secured fixed-price construction contracts for 70% of the estimated project cost, and if there are cost overruns, they have a number of mitigating mechanisms that would help them recoup part of that spend. Second, they partnered with the Mexican Federal Electricity Commission (CFE), which is a state-owned electric utility. The CFE will be responsible for securing land and permits, and given that it’s state-owned, I’d expect that this would reduce the risk of project delays and the subsequent cost overruns. So far, TRP has hit all their project milestones, so it looks like that partnership is paying dividends.

All told, at the asset level I think TRP has some great businesses. They’ve clearly stepped on a rake with Coastal GasLink, and erased billions of dollars in equity capital in the process, but it looks like that saga is coming to an end. I’m also encouraged by the fact that they don’t seem to have any other projects in the pipeline that face a similar cost overrun risk. The balance sheet is still a little stretched, but they’ve taken a few steps to address rating agency concerns, and I think there is a clear path to stable credit ratings in the near future. Against that backdrop, I think TRP looks reasonably appealing at the current price, which brings us to valuation.

Valuation

You can find all my detailed assumptions in the DCF Model (see Excel file link), but I’ll go over some of the core assumptions below.

To start, TRP has ~$28bn of secured capital projects (ex. Coastal GasLink) that will be placed into service over the next 4-5 years, with ~$19bn of incremental spend left from 2023-2027. As those projects come into service, the attached EBITDA hits TRPs income statement. Beyond these secured capital projects, I assume that organic reinvestment rates are de minimis, which means most of TRPs capex is on maintenance capital instead of new growth projects. Exhibit I illustrates what this looks like and shows what I think are reasonably conservative capital spending assumptions. It’s totally possible that TRP finds new growth projects to develop, particularly around gas pipelines, hydrogen, and carbon capture, but I’m not willing to pay for that today.

With these secured capital projects coming online, I think TRP can deliver a ~5% EBITDA CAGR through 2027. Given the low reinvestment rates I’m assuming, EBITDA growth for the five years after that would be just 1.5-2.0%/year (Exhibit J). For all the incremental capital spending in their regulated pipeline businesses – which makes up 90% of total capex in my model – I assume that TRP only earns a 10% ROE (which drives those EBITDA growth numbers). That probably ends up being too conservative, but it’s consistent with the lower end of TRPs historical adjusted ROE that I outlined in Exhibit E. That historical ROE is plagued by some big impairments on Keystone XL and Coastal GasLink, so implicitly I’m baking in a buffer for some future projects to go south. I think these are a safe set of assumptions to underwrite.

With this capital spending profile, no additional asset sales, but some modest proceeds from the DRIP, I think TRP can get down to the target 4.75x ND/EBITDA in ~3 years. Beyond that they should be able to hold leverage flat and self-fund the capital spending I’ve assumed above.

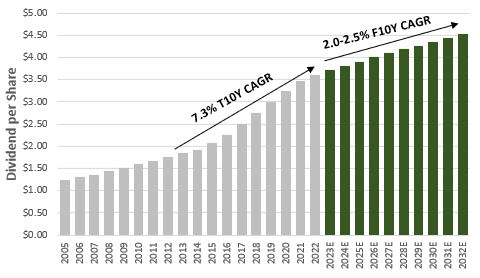

I make a few other assumptions around non-controlling interests, equity investments, cash taxes, legal charges, and so on, all of which you can find in the model. When all is said and done, I think TRP could deliver 2.0-2.5% dividend/share growth over the next decade under this scenario – effectively all free cash flow that isn’t required to fund their modest capital program gets returned to shareholders. In Exhibit L I show how that compares to historical DPS growth, and while DPS growth is likely to be much lower in the future than it was in the past, TRP is currently trading at a 7.54% dividend yield – you can think about that as almost a 7.54% real return. Not bad.

I’m using a 9.0% cost of equity, 5.50% cost of debt, 1.5% terminal growth rate (for equity), and ~10% terminal ROE, which works out to about a 12.5x terminal P/E multiple in the DCF model. You can find a screenshot of my DCF tab in Exhibit M, but with these assumptions I estimate that fair value is ~$55/share – that’s a ~10% premium to the current price and a 10Y IRR of ~10.5%.

While I don’t think these are “pound the table” returns, it’s important to reiterate that I generally used pretty conservative assumptions to get there. It’s a lot easier for me to paint a picture where TRP outperforms these assumptions than falls short. Despite some of the Coastal GasLink hiccups, I also think it’s true that this is otherwise a pretty low-risk business – I feel reasonably confident that the 7.54% dividend yield is A) sustainable, and B) that the dividend should grow modestly over time. As part of a broader portfolio, this is the type of investment that I think keeps the ball in play, which is why I’m now a shareholder (I was last a shareholder during the early days of COVID). It’s also fairly uncorrelated to a lot of the other business I own and should hold up well through the cycle. I’d love to make it a bigger position, and there do seem to be opportunities to do that at better prices – for example, when the Columbia asset sale was announced TRP briefly touched $44/share, which I think was an overreaction to the lower sale multiple on those assets. At that price I’m getting a 12%+ IRR, or an 8.5% dividend yield plus reasonable line of sight to low-single-digit DPS growth.

One final comment. TRP also announced that they would be spinning off the Liquids Pipelines business as a separate standalone entity. Despite management commentary that two standalone entities will be better positioned to pursue growth projects that might have otherwise fallen by the wayside (better focus, yada, yada, yada), I don’t personally think stuff like this changes the math on returns. In any event, some time next year the Liquids Pipeline business will be spun off. Who knows how each of these separate businesses will trade immediately following the spin, but it’s certainly something to watch for.

As always, if you have any questions or disagree with any of the analysis/views, please fire away in the comments below. You can also reach me on Twitter or the10thmanbb@gmail.com.