Investment Thesis

TC Energy (TRP 0.00%↑) operates a highly contracted network of energy infrastructure assets in North America, with a specific emphasis on natural gas pipelines. In our view, the market underappreciates the strong natural gas demand outlook, specifically driven by growing electricity demand and the shifting composition of the generation fleet. We also think that the market underappreciates TRP’s role in connecting that growing demand with some of the lowest cost natural gas basins in the world. There are also major barriers to entry and benefits of being a first mover for energy infrastructure, both of which should allow the company to earn attractive incremental returns as they build out their network. TRP has a long track record of profitability growing the business, is led by an excellent management team, and has a risk profile closer to that of a utility than a traditional midstream/pipeline company - most of which we can’t say about the majority of the company’s peers. TRP’s shares are trading at an attractive discount to our estimate of fair value, and we see limited downside to the current price. As such, we think an attractive opportunity exists to own a high-quality/low-risk business at a reasonable price.

Value Proposition and Customers

TC Energy (TRP:TSX) is one of the largest publicly traded energy infrastructure companies in the world, with assets that make up a large part of North America’s energy backbone. The company’s natural gas pipeline network connects prolific natural gas producing regions in Canada and the northeastern United States with demand centers all over North America. In fact, the natural gas pipeline network is so large that the company transports about 20% of all the natural gas produced on the continent. It’s helpful to visualize this, so we’ve included a snippet of their gas pipeline network in Exhibit A. The company also operates the Keystone pipeline system that connects oil producers in Canada with refineries in the United States, and has a partial ownership in the Bruce Power nuclear facility in Ontario.

The vast majority of TRP’s EBITDA is secured by a combination of long-term take-or-pay contracts or is under a regulated cost-of-service model, whereby the company receives a toll for volume commitments from their customers. It’s important to note that TRP doesn’t have any significant direct commodity price exposure, and has minimal volume exposure (<10% of revenue).

For the most part, there are no substitutes for pipelines, and without these transportation corridors, millions of consumers in North America would lack electricity, hot water, or heat for homes – not to mention, hundreds of commodity producers would cease to exist. It’s not worth going down the rabbit hole to categorize the composition of each and every one of TRP’s customers, but we can make some generalizations: first, the company is well diversified and most likely has many hundreds of customers; second, these customers represent both supply and demand centers, including oil and natural gas producers, utilities, and refineries; and third, the weighted average credit rating of customers is investment grade. We can use public filings from TRP’s Columbia Gas asset (18% of EBITDA) as a sample for these generalizations. From those filings we can see that: Columbia Gas had 176 shippers in January of 2020; the top 10 shippers on the system by volume – which make up ~55% of volumes – were split about 50/50 between producers and local utilities; and, the weighted average credit rating of those top customers was investment grade.

For a bit more color see Exhibit B for a breakdown of TRP’s business by segment, contract type, and currency.

Industry & Macro

To really understand the company, and why we believe an expectations gap exists today, it’s important to understand the supply and demand landscape for natural gas in North America. To do that, we’ll start with some simple energy axioms that drive our macro view:

The world is greedy for energy

The not-in-my-backyard (NIMBYISM) movement is a problem for large infrastructure of any kind

Producing and consuming regions will always be different

The clean energy train has left the station

Capital will always be constrained

LCOE (levelized cost of energy) will always matter

Gas Demand

The Energy Information Administration (EIA) is a treasure trove of US energy data, and much of our work is anchored to those data sets. Exhibit C shows the EIA’s breakdown of US natural gas demand since 2003. In total, domestic gas demand has grown at a CAGR of 2.2% over the last fifteen years, but the dispersion in demand growth by end-use is quite large.

Residential and commercial demand is largely driven by heating requirements. For most space and water heating, the only good options for energy are electricity and natural gas. When natural gas is available, it is typically the most efficient energy source for space heating and water heating, particularly in colder climates. As such, it is the primary heat source in the United States (link). We note that US population growth has averaged just shy of 1.0% over the last fifteen years, which has outpaced the actual growth in residential and commercial demand. In our view, this is almost entirely attributable to improvements in energy efficiency prompted by axioms 4 and 6. For example, EIA data for gas furnaces and boilers shows that they have achieved efficiency improvements of about 1.5%/year over the last two decades, making them both cleaner and cheaper to operate. There is obviously some upper limit on energy efficiency, but as boiler-technology-laymen, we don’t pretend to know where that is. In our base case, we therefore assume that the pursuit for better efficiency continues, and that residential and commercial demand growth in the coming decades is de minimis.

Industrial gas demand is more diverse, and includes a range of end-uses in manufacturing, mining, agriculture, forestry, and fisheries. In many cases it’s used as heat or power, and much like the residential and commercial space, it’s the cheapest and cleanest energy source. In other instances, it’s used as a chemical feedstock, and while there are some alternative biomass options, gas is by far the cheapest and most plentiful. We expect that industrial gas demand growth should be equal to GPD less modest efficiency gains over time.

The holy grail for gas demand ultimately rests in the power market, so it’s worth exploring in greater detail. The two KPI’s for power demand are population growth and consumption per capita. Exhibits D and E show IEA data from select developed and emerging economies for nominal power demand per capita in 2014, and the trailing 20-year CAGR for those consumption figures. Globally, power consumption per capita has increased by almost 2% a year, although it’s clear that developed markets seem to have reached the asymptote; homes in developed markets already have dishwashers, microwaves, two TVs, computers, iPhone chargers, and air conditioning units. Once people acquire these things, it becomes hard to do without; the world is greedy for the devices that electricity powers, after all.

As it relates to North America, power demand per capita, population growth, and GDP growth have all been low for more than a decade, which begs the question, “how has power-related gas demand grown so much?” The driving force, based on our analysis, has been market share gains.

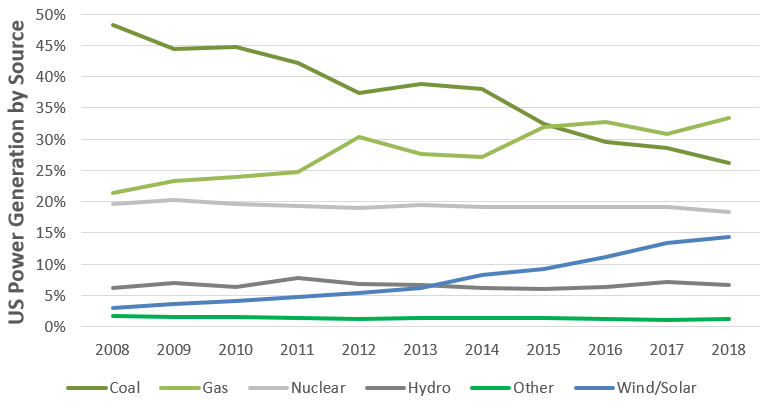

Exhibit F shows EIA data for US power generation by type over the last decade. The market share of coal generation has nearly halved, while renewables and natural gas filled the void. Over that period, the market share of natural gas is up 12%. The contributors to this generation shift can be tied to axioms 2, 4, 5, and 6. We’ll explore them in no particular order.

First, environmental policy has increasingly focused on reducing greenhouse gas emissions, and in that respect, coal is the low-hanging fruit. In the United States, the average natural gas power plant produces ~58% fewer kg’s of CO2 per kWh of electricity than the average coal power plant, with brand new gas plants producing ~65% fewer emissions. While it’s true that the least efficient coal plants were likely the first to retire, the gap remains quite large, and we expect to see continued coal retirements in the next two decades. We’ll ignore the obvious emission reduction benefits of nuclear and renewables for a moment.

Second, LCOE matters, and in most jurisdictions, gas is cheaper than coal. The shale revolution drastically reduced the cost of natural gas, so even without environmental policy, it’s likely that coal would have lost some market share to gas over the last decade anyway. But, environmental policy is real, and a number of power markets have adopted carbon pricing schemes, which take a variety of shapes, but ultimately create new costs for natural gas and coal power plants. With emission intensity so much greater for coal, the costs that those plants incur are also meaningfully higher than natural gas plants. This exacerbates coal’s economic disadvantage. As an example, recently instituted carbon pricing in Alberta has directly resulted in coal-to-gas conversions. Unsurprisingly, carbon pricing schemes today exist only in Canada, California, and the US northeast, and have been a point of contention in most parts of North America. Nevertheless, climate-change concerns are escalating, and we expect to see more states force the cost of these externalities on the power sector in the coming decade, which should continue to result in coal plant retirements.

If environmental policy is ultimately driving coal retirements, the next big question becomes how does the void get filled in the future? Ignoring natural gas, the other options are nuclear and renewables, but we think that both of these generation categories face serious hurdles.

Data from the US Nuclear Regulatory Commission (NRC) shows that the average age of nuclear power plants in the United States is about 40 years. The NRC gives out 40-year licenses to operate a reactor, with 20-year life extension options, which are only granted if a significant amount of refurbishment is complete. In many geographies, where renewable and natural gas capacity are prevalent, this is frequently uneconomic given the safety standards nuclear generators need to meet. We suspect that these old nuclear reactors will be slowly decommissioned, which puts more pressure on either new nuclear reactors or other sources to fill the gap.

What’s really interesting is that new nuclear power plants are really, really, really hard to build cost effectively. The last nuclear reactor to be placed into service was a brownfield expansion of an existing facility in Tennessee in 2016. Before that, the last reactor to be placed into service was 1996 (check out this list). It’s not hard to see why. Georgia Power is currently working on building two new reactors at the Vogtle power plant (units 3 and 4). The original cost estimate was US$14.0 bln in 2008, with an expected in-service date of 2017. As of today, the new cost estimate is US$25.0 bln, and the new in-service date target is 2021. A few of the companies involved in the project have gone bankrupt as a result of delays and overruns, and regulators are irate. There are a couple of other projects underway that have faced similar headwinds, and the general experience has been negative. On top of a sour taste in the mouths of regulators and corporates, society has adopted a strong NIMBYISM stance after some of the recent nuclear disasters globally. Right or wrong, it’s easy to see why a community wouldn’t want a nuclear facility in their back yard. The combination of these factors likely means that new nuclear power plants will be a much smaller part of the generation stack in twenty years.

The renewable energy backdrop is much better, although faces different hurdles. As we understand it, there are few good locations left for hydroelectric facilities, and their share of the generation stack has been flat at about 7% over the last two decades. As a result, most the renewable growth has come from wind and solar, which saw a quintupling of combined market share over the last decade. The cost curve fell at an astonishing rate, and even with subsidies rolling off, wind and solar are cost competitive in a growing number of geographies. For example, a 2017 wind procurement process in Alberta awarded 400 MWs of contracts to a handful of developers for a weighted average bid price of just C$37/MWh. This compares to contracts awarded in Ontario in 2009 at C$135/MWh.

However, the biggest problem with both wind and solar is intermittency. When the wind doesn’t blow, or the sun doesn’t shine, no power is produced. Power demand fluctuates a lot on a daily and seasonal basis, and if the entire grid was powered by wind and solar, there would be constant brownouts. To prevent that from happening, a more reliable and controllable energy source, like gas, is also needed. The other solution would be to build an extraordinary amount of utility-scale electricity storage, but despite significant improvements in power storage over the past decade, this is still far from cost effective today, and because LCOE matters, we don’t see this becoming a part of mainstream energy infrastructure for a long time. Even when it eventually becomes economically feasible, capital is still a constraint, and we suspect it would take many decades to build sufficient capacity to replace gas completely. In a way, natural gas appears to be the bridge fuel to a fully renewable future, but that bridge might take us a century to cross (we say this facetiously, but only slightly). We’d be surprised if wind and solar market share didn’t grow 2.0x by 2040, but don’t see it as a panacea in any reasonable time horizon.

On top of the changing composition of the generation stack, the electrification of the vehicle fleet could also provide a boost to total power demand growth. It would be optimistic to even say that the magnitude of demand growth from electrification is hard to forecast, but we’ve taken a stab for illustrative purposes. Roughly 3.3 trillion vehicle miles were driven in the US during 2019. The long-range Tesla Model 3 uses about 26 kWh per 100 miles, and is one of the more efficient EVs today. Making some assumptions for battery efficiency and line loss, we estimate that if the entire US vehicle fleet was electrified today, total power demand would increase by about 1,100 TWh, which would be a >25% increase in total US power demand. If 40% of the vehicle fleet was electrified by 2040, and vehicle miles driven grew at 1.0%/year, we’d expect that power demand would grow by an incremental 0.5% CAGR over the next two decades. The pace at which North America electrifies the vehicle fleet is contentious, but in an effort to be transparent with our assumptions, you can find our simple EV penetration model here.

The combination of GDP growth, vehicle and other electrification, and market share gains, could drive power-related gas demand of ~5%/year for multiple decades, which we think bodes well for gas pipeline companies.

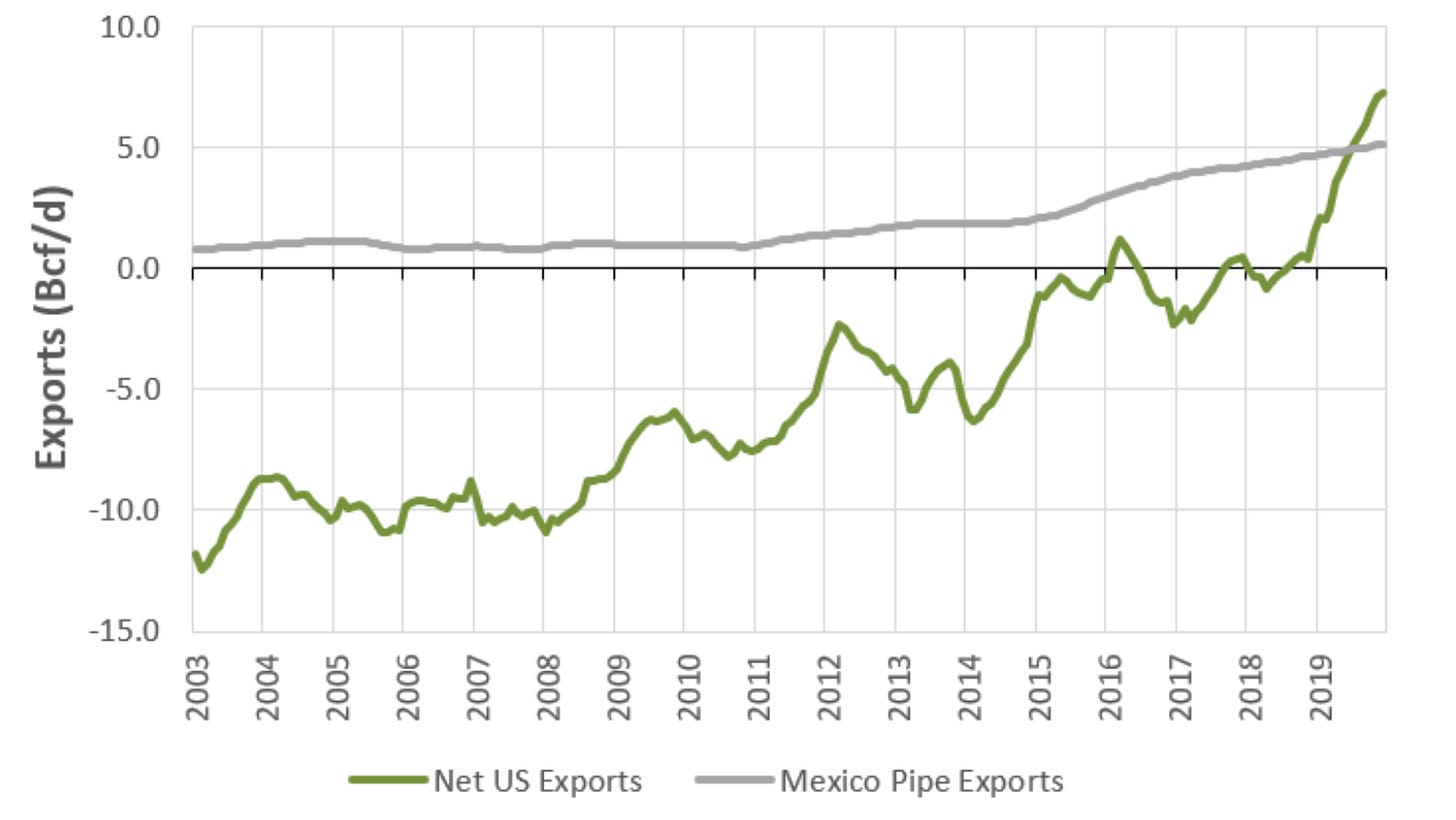

Lastly, for decades the United States was a net importer of natural gas, most of which came from Canada – in fact, all of Canada’s exports go south. But then the shale revolution lowered the cost of natural gas in lots of US basins, and it started to make sense to build liquified natural gas (LNG) facilities to export gas to other markets. A number of new gas pipelines were also built into Mexico. Exhibit H shows net US exports, and the dramatic change over the last two decades. By the end of 2019 the US was exporting more than 7 Bcf/d. EIA data shows that total US LNG capacity should surpass 10 Bcf/d by the end of 2021, with modest growth in pipeline capacity to Mexico. In Canada, a number of LNG projects are also progressing, with potential capacity additions of 5-6 Bcf/d by the mid-to-late 2020’s.

In aggregate, we expect that domestic growth coupled with export growth, could accommodate a 3%+ CAGR in gas production from the United States and Canada over the next twenty years. This growth expectation appears to be 0.5-1.5% above consensus. Our best guess is that the delta is explained by more conservative EV penetration and market share gain assumptions by consensus.

Gas Supply

Exhibit I shows EIA data for gas production in the United States by basin. The shift in the last ten years is pronounced. The Appalachian region in the US northeast was essentially nonexistent ten years ago, and now produces a third of US natural gas. On the flipside, legacy gas production has blown down by more than 60%.

Exhibit J shows the same gas production data per basin versus oil production from those same basins. We can use this data to understand how much gas is produced purposefully, versus how much gas is a by-product of oil production (called associated gas). Clearly, the Appalachia and Haynesville are gas-specific basins, while all the rest, to varying degrees produce associated gas. In 2007, the Appalachia and Haynesville generated only 9% of total US production, but in 2019 they made up 45%, adding more than 40 bcf/d in the process. The primarily oil basins produced 26% of total US gas in 2007, and now account for 40% of total supply, up 26 Bcf/d. For the most part, associated gas would be produced even if the price of natural gas was $0.00/mcf. In fact, so much gas is produced in Texas without a home, that 2.0+ Bcf/d is literally burned off at the well head. In part as a result of this price-agnostic gas supply, prices in North America have come down a lot from a decade prior. Yet, despite the low-price environment, the Appalachian region continues to grow rapidly, which is a testament to the extremely low-cost nature of the basin. For context, gas production per rig (one measure of efficiency) was up nearly 40x in the Appalachian region from 2007 to 2019, and yet the cost per rig-day has changed very little.

We expect that associated gas will be a permanent part of the supply picture for a long time, but a slowdown in oil production will also result in lower gas production from oil basins, and increase the burden on the Appalachia, Haynesville, and Canadian basins. We estimate that a 1.0 mmbbl/d decrease in US oil production would result in just shy of a 4.0 Bcf/d decline in associated gas production (4% decline on US total). Another way to think about this is to figure out what kind of oil growth would be needed such that associated gas production maintains market share to meet growing North American gas demand. If gas demand does grow by 3%/year through 2040, we estimate that oil production in the US would need to grow by 11.0 mmbbl/d to keep associate gas market share flat at 40%. If associated gas met all of the incremental gas demand growth, oil production would have to grow by 27 mmbbl/d! For context, global oil production is only ~100 mmbbl/d today. The IEA has a range of forecasts for 2040 that contemplate oil demand anywhere from 66 mmbbl/d to 106 mmbbl/d. Against that backdrop, it seems incredibly unlikely that the US will add even 11.0 mmbbl/d, particularly given recent OPEC and Russia actions. In our view, there is compelling evidence to suggest that Canada, the Appalachia basin, and the Haynesville will take market share and play a critical role in meeting future demand needs.

The TRP gas pipeline network (see Exhibit AA) is one of the major transportation options for gas produced in the WCSB and Appalachian basin. They also serve some of the largest demand centers in North America. One of the common pillars to the bear thesis on TRP is that very few of the company’s assets service regions rich with associated gas, although we clearly don’t see this as a problem. With demand growth likely to occur all over the continent, the most effective way to service that demand is with laterals off of existing long-haul pipeline networks, particularly those that originate in growing supply regions. To that end, TRP is incredibly well positioned to deliver low-cost energy to millions of North Americans for decades to come.

Competitive Position

Since TRP has assets in a variety of geographies, and in a variety of different businesses, it’s important to think about competitive advantages specific to each asset. That being said, some common themes crop up across the portfolio.

First, barriers to entry are massive. As we’ve highlighted before, NIMBYSM is a big problem for building new infrastructure of any type, but hydrocarbon transportation in particular. There are also professional activist organizations that push back on projects in every single regulatory process. When we think about new long-haul pipelines, some of the biggest challenges are obtaining the right-of-way, regulatory approval, and permits. Building a new gas pipeline into the heart of New York might as well be like trying to land a human on the sun. Likewise, building a new long-haul oil pipeline between any markets is like pushing an elephant into the trunk of a Prius. They both sound like really fun ideas, but no one wants to try it twice.

The second common theme is that the first mover to supply an infrastructure need often ends up with a captive customer. For most long-haul projects or large gathering networks, a threshold level of volume must backstop a project to make the unit-economics work for shippers; for example, it doesn’t make sense to build a 5,000-mile gas pipeline to move 100 mmcf/d, but it might for 5 Bcf/d. One way these projects can be backstopped is with 20-year take-or-pay agreements, where shippers can’t leave without paying for their capacity commitment. The other way, is to charge a tariff based on a cost-of-service framework, whereby a fixed amount of revenue is earned regardless of how many molecules flow; for every molecule that might flow on another system, the tariff on remaining molecules would rise to offset that revenue loss. This also acts as a hurdle for shippers that might look to backstop another pipeline.

Typically, once a pipe is in the ground and has customer commitments, it’s often cheaper to add new capacity to the incumbent system then it is to backstop a new project, so the incumbent tends to capture most of the subsequent growth opportunities. In our view, having been the first mover has allowed TRP to benefit from a network effect, and positioned them to have near-monopolies in particular regions and corridors. One reason this happens is that pipelines can add incremental compression stations, loop or twin certain sections in the same right-of-way, or add laterals to meet demand growth along the corridor, which creates more capacity on part of the system. These expansion projects typically require a much lower volume commitment than the volume threshold required to backstop a brand-new project. Lastly, under the cost-of-service framework, once a pipeline is modestly depreciated, there tends to be a large gap between rate base and replacement cost, which makes it difficult for new projects to offer competitive tariffs.

To illustrate these in action, we’ll walk through a few of TRP’s larger assets.

NGTL (12% of 2019 EBITDA)

This gas gathering system in Western Canada is effectively a regulated monopoly. The Canada Energy Regulator (CER) fixes the NGTL ROE at 10.1%, and approves all system expansions. Almost all of the gas producers in Western Canada would use NGTL to connect at least some of their volumes to long-haul export pipelines, including many of TRP’s own assets. For context, the system handles ~75% of Canadian gas production (an illustration is worth a thousand words – link). The demand for NGTL services is so strong that the CER has already approved billions of dollars of system expansions out to 2023.

In our view, one of the major NGTL advantages is a network effect. The network has over 1,100 receipt points and 300 delivery points. It is connected to almost every major demand center in Alberta (power plants, oil sands projects, industrial end markets), large gas storage assets, and most of the long-haul export pipelines. With more volume on the system, it becomes easier to backstop firm commitments to build new delivery points, expand capacity, and support long-term firm transport commitments on the Canadian Mainline. In our view, if the NGTL system was instead a dozen distinct gas transportation systems, the average tariff per mcf would be significantly higher.

As the cheapest transportation option, with the most flexibility, we believe that NGTL will capture most of the incremental growth opportunities for gas transportation within Western Canada. We see the system growing meaningfully for more than a decade as local demand for gas grows, LNG projects come online, and export capacity to the east coast increases.

Canadian Mainline (10% of 2019 EBITDA)

Much like the NGTL system, the Canadian Mainline is a long-haul gas pipeline network regulated by the CER, which has set an approved return on equity of 10.1%. The pipe originates in Alberta and transports gas to Eastern Canada and the United States. Like any cost-of-service model, if volume falls on the system, tariffs on remaining molecules increases to meet revenue requirements. From 2007 to 2013, receipt volume in Alberta on the Canadian Mainline fell from 7 Bcf/d to just under 2 Bcf/d. As a result, the Mainline toll for long-haul service rose from ~C$1.00/mcf to over C$2.00/mcf, and TRP continued to earn a return on equity in excess of 10%. This is the perfect example of why a cost-of-service model is valuable to the infrastructure owner.

On the flip side, TRP temporarily reduced nameplate capacity to only 3 Bcf/d, and has spent very little incremental capital on the system. From 2007 to 2019, the Canadian Mainline rate base fell by nearly half, and net income fell by about 40%. As the only long-haul gas pipeline with service to Eastern Canada, and one of the only export options to the Eastern United States, TRP’s shippers are largely captive, and spent considerable effort working with TRP to reduce tolls on the Mainline to a more competitive level – this would benefit shippers, and prevent further deterioration in rate base on the Mainline. In 2017, TRP reached a deal with 23 shippers to sign ~10-year firm commitments for 1.5 Bcf/d of capacity, at an average toll of just C$0.77/mcf (the LTFP service). In 2019, the Mainline flowed ~3 Bcf/d, which was effectively 100% of available capacity. As a result, we expect that the Mainline rate base will stabilize in the near-term.

With the Mainline operating around current nameplate capacity, LTFP tolls at a more competitive level, and gas demand expected to grow meaningfully in North America, we believe that TRP will look to eventually bring the remaining 4 Bcf/d of capacity on the Mainline back into service. In our conversations with gas producers and TRP, it’s clear that another long-term volume commitment would be needed to backstop a return of service for incremental volumes. TRP would likely require only modest capital relative to a greenfield project to ramp up capacity, which would likely result in an even lower toll for shippers. We’d be surprised if this didn’t happen in the next 4-5 years, and build it into our base case.

Coastal GasLink (CGL; under construction)

The CGL project will be the sole source of supply for the LNG Canada project on Canada’s west coast, which is owned by a consortium consisting of Shell (40%), PETRONAS (25%), PetroChina (15%), Mitsubishi (15%), and KOGAS (5%). TRP signed 25-year initial commitments with multiple renewal options, which guarantee a return on and of capital with high credit-worthy counterparties. The LNG Canada project is proceeding with two trains, with the option to add two additional trains in the future. Our conversations with various people involved with the project suggest that all four trains will ultimately go ahead. CGL has initial capacity of ~2 Bcf/d to service the first two trains, with the option to expand the pipeline to 5 Bcf/d if/when the next two trains move forward. This is a perfect example of a captive customer – the expansion opportunity is TRP’s alone. We don’t model an expansion into our base case, largely because an FID would be years away, and a lot can change in LNG markets.

CGL will originate in northeast B.C., and connect to the NGTL system. It’s highly likely that any expansions to CGL will also result in new opportunities to expand the company’s NGTL network.

In 2019, TRP sold a 65% interest in CGL to KKR and AIMCo to help fund the project, at a price that we believe increases TRP’s ROE into the mid-teens, and is a great example of disciplined capital allocation.

ANR Pipeline (7% of 2019 EBITDA)

The ANR Pipeline is one of the older pipeline assets in TRP’s portfolio. Originally, there were two main pipelines in the ANR system that originated in Texas/Oklahoma and Louisiana, and both converged near Chicago. The southeast leg, which originated in Louisiana and transported dry gas from the Gulf of Mexico up to demand centers around the Great Lakes, was reversed in 2014. We’re not ANR historians, but note that dry gas production in the Gulf of Mexico fell by more than two thirds from 2006-2014, which clearly created an opportunity to repurpose the corridor. The southeast leg of ANR can now ship gas from Canada and the Appalachian basin to markets on the Gulf Coast. A number of ANR expansions have taken place in recent years to accommodate growing gas supply from the Appalachian basin, and the system’s rate base has almost doubled in the last five years. Two additional expansions are expected to increase capacity on ANR through 2022, and should contribute to additional rate base growth.

In our view, ANR is one of the best examples of why incumbent pipelines are so valuable. The tariff on ANR is largely tied to the net book value of capital spent on the pipeline (rate base). The capital to build a pipeline reflects the cost to purchase the right-of-way, labor, and materials. The cost of land, labor, and materials when ANR was built would be some small fraction of the cost of those inputs today, and as a result, the tariff on ANR is a fraction of what a new-build pipeline would cost. Ongoing maintenance and replacement projects are also spread out over a long period of time, which adds to the rate base, but does so slowly. The last ANR rate case was filed in 2016, and shows that the tariff to ship gas from the Northeast to the Gulf Coast would be somewhere in the US$0.70/mcf range. We suspect that this rises modestly as the rate base grows through the early 2020’s, but will still be a fraction of a new-build tariff. Based on cost/mile heuristics for brand new pipelines, which suggest US$6-7 mln/mile, we estimate that the tariff on a competing greenfield pipeline would be ~US$1.75-2.00/mcf, which is more than two times higher than ANR.

Another clear indicator of demand was the willingness of ANR shippers to sign 23-year contracts for essentially all of the southeast ANR capacity in 2014. We expect that more of these long-term deals will backstop future expansions to ship Canadian and Appalachian gas to the Gulf Coast over the next decade, particularly if US LNG capacity in Louisiana and Texas continues to grow.

Columbia Gas and Columbia Gulf (20% of 2019 EBITDA)

TRP acquired these assets in 2016, and they’ve become a major area of growth for the company. In many ways, we’d liken Columbia Gas to NGTL in Alberta, and Columbia Gulf to ANR. These assets are regulated by FERC, which sets out an approved ROE similar to the CER target.

Columbia Gas is a large pipeline network that collects gas from the Appalachian basin (Pennsylvania, Ohio, and West Virginia - link), and connects it directly to major demand centers in the US northeast, and to a number of other short and long-haul pipeline systems. The system benefits from many of the same themes as NGTL, but in a much larger market, with much larger regional demand growth potential. We attempted to count all of the coal power plants that sit along the Columbia Gas pipeline corridors, and estimate that almost 40 GW of coal capacity, representing ~17-18% of the US total, could be connected to Columbia Gas by relatively short laterals. Many of these states are pretty coal friendly, but ultimately, we’d expect most of these plants to convert – it might take 20 years, but the clean-energy train has left the station and we don’t see it slowing down.

As we understand it, TRP will get approached about building a lateral to supply a converted coal plant, and the power plant customer signs a 20-year take-or-pay commitment to backstop TRP’s capital spend. Even though the pipeline system is regulated by FERC, TRP and the power plant can enter into a unilateral agreement without going through a FERC process. This ends up being easier and faster for both parties, and TRP tends to earn an ROE that’s 200-300 bps higher than the FERC target, which makes these small capital projects much more profitable than large system expansions. Typically, the new customer only has one feasible supply option, which is the reason that incumbent pipeline networks can earn a return on equity in excess of the FERC target. Another argument might be that TRP has capital constraints, and long-term take-or-pay contracts with higher ROEs are required to incentivize TRP to deploy capital for these projects over other capital deployment options. Other industrial, heating, and power demand should drive growth in tandem with coal-to-gas conversions over a long period of time, and will likely result in many small system expansions that earn similarly attractive returns. As of 2019, we estimate that about 50% of TRP’s US pipeline assets fall under the FERC cost-of-service tariff framework, and the rest are negotiated tolls. One thing to note is that even when the contracts from negotiated tolls roll off, the asset becomes part of the total system rate base, so there isn’t the typical re-contracting risk found in unregulated long-haul pipes.

Columbia Gulf connects to Columbia Gas, and was reversed to bring Appalachian gas to the Gulf Coast, specifically Louisiana. At almost 6 Bcf/d of total LNG capacity, Louisiana has more than half of total Gulf Coast LNG market share today, and the state’s capacity could more than triple if all the proposed projects moved forward. It’s unlikely that every proposed project sees the light of day, but if even a couple additional trains are built, it could increase demand for gas from ANR or Columbia Gulf. We don’t have our fingers on the femoral pulse of US LNG, so it’s difficult to model LNG-driven growth on pipelines like Columbia Gulf. There are also competing pipelines in the Gulf Coast region that could take some of that share. That being said, risk appears skewed to the upside on gas volumes through this system.

Keystone and Keystone XL (17% of 2019 EBITDA; under-construction)

The three major existing export pipelines in Canada are the Canadian Mainline, Trans Mountain, and Keystone, and in recent years these have all operated at 100% of capacity. Enbridge owns the Canadian Mainline, which is a collection of many different pipelines, some of which were commissioned in the 1950’s and still operational today. Trans Mountain was owned by Kinder Morgan, and recently purchased by the Canadian government, and has been in operation since 1953. Keystone, which is the bright-eyed and bushy-tailed little sister in the trifecta, was commissioned in 2010, and was backed by 15 to 20-year take-or-pay commitments. If the other two systems are any indication, the Keystone pipeline could be operational until close to 2100.

NIMBYISM and climate activism plague oil pipelines like almost no other asset class, which makes existing oil export pipelines in Canada extremely valuable – the incumbents will remain unchallenged. Enbridge has been trying for years to replace Line 3 on the Mainline, which would substitute a 60-year-old pipe with a brand new one, and increase capacity on the system by a few hundred thousand barrels per day. At a high level, this makes the system more reliable, and reduces the chance of a spill dramatically, so it would seem to make sense. And yet, we followed the regulatory process closely – specifically the regulatory hearings with the Public Utility Commission in Minnesota – and were taken aback by how controversial a decision it was. At one point, protesters stormed the hearing, and at another, the commissioner for the PUC broke down in tears about her decision to let Enbridge proceed with the project. Intervenors took all shapes and sizes: landowners along the route, aboriginal groups, climate activists, local communities, and concerned youth. Our takeaway from watching this play out, was that community support is absolutely needed for the entire length of the pipeline corridor, and that there will almost certainly be at least some states or provinces where it doesn’t exist. Because of this, most management teams that we’ve talked with have indicated that they have very little appetite to ever pursue another 5,000-mile oil export pipeline.

The other two potential Canadian oil export projects, TMX, and Keystone XL, had to be backstopped by the government to proceed. TMX was purchased outright by an arm of the Canadian federal government, while Keystone XL received an equity cheque and government-guaranteed debt from the Alberta provincial government. Construction on Keystone XL is expected to begin imminently, and be complete sometime in 2024. Once these projects are complete, we don’t think another greenfield long-haul oil pipeline will ever be built out of Canada.

It's worth noting here that we still see risk on the Keystone XL pipeline, and have risked the project at 90%, assumed 10% cost overruns (50% of which TRP eats), and a one year delay to the in-service date.

Now for some optimism. The oilsands represent more than three quarters of Canada’s oil production, and have incredibly low decline rates, which makes breakeven cash costs pretty low. With that in mind, we suspect that once oil pipelines are filled, they will remain full for decades. Keystone XL will originally see 80% of capacity backed by 20-year take-or-pay commitments, and the original Keystone system still has a remaining contract life of about 8 years. Once these contracts roll off, our base case assumption is that the capacity is re-contracted – there won’t be new competing options, after all. The Keystone system, as the youngest pipeline network out of Canada, also faces much lower risk of forced decommissioning or de-rating because of pipeline integrity, despite some of the recent hiccups. In our view, these assets will provide TRP with stable cash flows for decades to come.

Bruce Power (6% of 2019 EBITDA)

Bruce Power has 8 reactors, and supplies almost 30% of Ontario’s electricity. TRP has a 48% interest in Bruce by way of leases from Ontario Power Generation (OPG). Units 1 and 2 were both refurbished in 2012, and Bruce Power reached a long-term agreement with the IESO to undergo a major replacement program for the remaining units starting in 2020 and running through 2033. Much like a regulated utility, TRP will earn a return on and of capital for this spending through 2064, when the leases expire. TRP’s share of total capital requirements were estimated at over C$8.0 bln in 2018 dollars, which provides an attractive growth runway for TRP. This is a critical piece of power infrastructure in Ontario, and given how much new capacity would have to be added to replace 30% of Ontario’s generation cost effectively, we don’t worry about early decommissioning.

Mexico Pipelines (6% of 2019 EBITDA)

TRP owns a handful of pipelines in Mexico that are regulated by the CFE, much like a utility, but unlike a utility the CFE is also the anchor customer on the systems. Many of the pipelines were built to transport cheap gas from the US to power plants and industrial facilities in Mexico, and were commissioned under a business-friendly Mexican government. As we understand it, the pipelines are backed by take-or-pay contracts, but in some cases the pipelines were commissioned before Mexican industry had the capacity to consume the gas downstream. When a new leftist Mexican government was elected in 2018, they took issue with what they called “exorbitant” contracts, and there were concerns that the new government would pull out of previous agreements (particularly for empty pipelines). At present, it looks like TRP’s contracts will be fine, but this is certainly a small risk to the business. That being said, Mexico does ultimately need the gas, does require external investment, and can’t afford to sour relationships with the US or Canada. TRP’s Mexican assets earn a higher return on equity than other US and Canadian regulated pipelines to compensate for this risk, but it’s clear that they will refrain from incremental spending in Mexico in the near-to-medium term. In our base case, we assume relatively flat contributions from Mexico.

Strategy

For the most part, TRP customers are captive, and growth over the short-to-medium term is dependent on things outside of the company’s control like demand or production growth in the markets TRP serves. What the company can control is long-term strategy, how they contract new projects, and capital allocation.

The long-term strategy is clearly to connect basins with the lowest cost of supply to regions with a favorable demand outlook. It is through that lens that the company purchased Columbia Pipeline Group in 2016. In our view, there are currently very few gaps in the portfolio, and TRP has a long runway of organic growth opportunities. As a result, we expect very little change in the composition of the business over the next 5-10 years. The management team has indicated multiple times that they have a wish-list of attractive assets in their internal M&A database, but no need to pursue them should IRRs not exceed the organic opportunity set.

When it comes to organic growth opportunities, the management team has a clear preference for contracted infrastructure, with little-to-no volume or price risk. The appetite for large complicated projects is also quiet low, without a mechanism to reduce the risk to TRP shareholders. For example, Keystone XL is supported by long-term commitments from shippers and capital from the Alberta government, Bruce Power has long-term agreements with the IESO, new NGTL growth is backstopped by lots of producers under a cost-of-service model, and expansions on the US gas system are backed by long-term take-or-pay contracts with producers and consumers. It’s incredibly unlikely that TRP deploys significant capital in higher risk projects.

Performance

The company’s performance over any period of time has been impressive. Exhibit K shows trailing total shareholder returns (to April 1, 2020) for TRP, the TSX Composite, and the S&P500, inclusive of reinvested dividends; TRP outperformed both indices over 5, 10, 15, and 20-year periods. We even included the trailing 10 years to January 1, 2020 to show that TRP kept pace with the S&P500 during a massive bull market led by incredible returns in the technology sector. The returns are even more impressive considering all the negative macro events in energy markets over the last decade.

Our model incorporates data back to 2007, and the company grew EBITDA at ~7.5%/year in the twelve years since, while also paying an average dividend yield of ~4.5%. There are different ways to think about cost of equity, but one that we find useful is the opportunity cost of the market return, which was roughly 8% over the last ten years. In Exhibit L we plotted the company’s historical and expected returns vs. the opportunity cost, and in our view, the team has done a good job earning above their cost of capital, with one caveat.

In 2015 and 2016, TRP incurred asset impairments on Keystone XL and some legacy power assets that were purchased two-ish decades ago. The power assets were from a by-gone era, and we give the current management team a pass on those, and believe the current strategy clearly excludes incremental investments in those types of power projects. Keystone XL is a little fuzzier. The project was originally proposed in 2008, but was delayed ad infinitum. By 2015, the management team at TRP decided that the project was probably dead in the water, and wrote off ~$3.0+ bln pre-tax. Obviously, it’s never great to see $3.0 bln burn, but we have to give the management team kudos for how they’ve approached the project since then. By spending a very modest amount of actual and human capital to keep the project alive, they were able to retain the option to proceed at some later date. Lo and behold, Western Canada ends up being massively pipeline constrained in 2020, TRP manages to weave through the years of legal and regulatory hurdles, and the Alberta government steps in to support the project with an equity cheque and provincially guaranteed debt in early April. It now looks highly likely that Keystone XL moves forward, and that TRP earns a return on all of the previously written off capital. A rare positive in the North American graveyard of impaired energy assets.

Financial Position

From 2015 to 2019 TRP embarked on a major growth capital program, and also purchased Columbia Pipeline Group. ND/EBITDA rose temporarily to an all-time high, but has fallen meaningfully as the company pulled a number of different funding levers, including asset sales. In 2020, we expect that ND/EBITDA will remain in the high 4.0x range, and move toward 5.0x as Keystone XL construction ramps up. In our view, this is appropriate leverage for a company that looks more like a utility than most midstream or pipeline companies, and ND/EBITDA is lower than many of the high quality utility companies we follow. Beyond 2023 we expect that TRP will have sufficient internally generated cash flow to simultaneously fund a modest capital program and reduce ND/EBITDA to near 4.5x by 2030. Exhibit M shows historical spending and leverage vs. our expectations. It’s also worth noting that TRP’s debt maturities are spread out over a long period of time, so we don’t need to worry about liquidity.

The company has issued both hybrids and preferred shares, which the rating agencies treat as 50% debt and 50% equity. Our ND/EBITDA exhibit reflects this, and hybrids/prefs make up just shy of 25% of TRP’s total non-common-equity capital. The latest S&P credit report forecasts comparable leverage to us, and they maintain a stable outlook on their BBB+ rating. TRP has indicated that they could turn the DRIP back on, or issue equity through an at-the-market (ATM) program if they need additional funding, although we think this is unlikely. Rather, the most obvious funding lever, should it be needed through 2023, is a partial sale of Keystone XL. We’ve been told that TRP could “sell a minority stake in KXL, 19 ways to Sunday if the project was sufficiently de-risked”, which we suspect it will be before TRP needs to spend any meaningful amount of the company’s own capital. Our base case includes a 35% sale of KXL in 2022 for C$5.0 bln, which would alleviate all external equity needs.

We note that TRP’s sustaining capital requirements are equivalent to DD&A for most cost-of-service assets, but slightly less than DD&A for most new contracted infrastructure backed by long-term take-or-pay agreements. We therefore assume sustaining capital requirements are ~85-90% of total DD&A.

Lastly, the average earnings payout ratio has been about 75-80% over the last decade. We assume it remains in that range in the future. Given the likely overstated impact of DD&A, and levers available to defer taxes, the payout on funds from operations is modestly lower than that.

Exhibit N shows historical cash uses and sources versus our base case forecast. We are quite comfortable with leverage and funding in the base case.

Management & Governance

In our view, the management team at TRP is excellent. Russ Girling joined the company in 1994, and took the CEO reigns in 2010. It was under his tenor that TRP grew to one of the largest, most consistently profitable, and attractively contracted energy infrastructure companies in the world. Don Marchand also took the CFO role in 2010, and is one of the most straightforward and conservative CFOs we’ve met, which we believe has helped TRP avoid many of the funding and balance sheet problems that other North American midstream and pipeline companies have faced. In combination with a solid bench of other managers, TRP has navigated two major energy downturns, a negative change in US tax law for cost-of-service businesses (ironically), and the COVID pandemic, all while outperforming the broader market.

Management compensation is tied to rolling three-year TSR and EPS growth, in addition to a number of corporate objectives like safety & integrity (emphasis here), asset optimization, and project execution. LTIPs tend to make up about two-thirds of total compensation for named executive officers, and is paid in a 60/40 split of deferred share units and stock options. The deferred share units vest after three years, and options are issued at par and have a seven-year term. In total, at the end of 2019, the top 5 executives owned $30 mln of shares, had $12 mln of unvested shares, and $68 mln of unvested stock options, for a total value of $110 mln (11.0x annual cash compensation). In addition, TRP has a minimum share ownership requirement for executive vice presidents, senior vice presidents, and regular vice presidents. We’d normally prefer to see ROIC/ROE metrics as criteria for management compensation, but EPS growth is reasonable for a predominately regulated cost-of-service business, and, the large equity ownership at all levels clearly aligns management with shareholders.

The board of directors is composed of some heavy hitters including the former CEO of Suncor, former CEO of Hydro-Quebec, former CFO of Nexen, former CEO of Bell, former president of the UofA, current vice-chair of PETRONAS, current director of Phillips 66 and Apache, and former CEO of the Potash business at Nutrien. The board is reasonably diverse, and we like that it has representation from some large TRP customers.

Valuation & Scenarios

The key drivers in our model can be distilled down to growth capital opportunities, contracting terms, leverage, cash taxes, and regulated cost-of-service assumptions like ROE, equity thickness, and depreciation rates. You can find detailed assumptions in our model, but the important ones include:

Keystone, and Keystone XL: we risk the project at 90% and assume a delayed 2024 in-service date with 10% cost overruns. Management guides to US$1.3 bln of EBITDA on KXL, which we use in the base case, but take utilization on the existing Keystone pipeline down 15% in 2024 to reflect lost volumes from transferred contracts, with 1%/year volume growth to partially fill capacity thereafter. We assume that the Keystone System toll inflates at 1%, which is typical for these projects. Lastly, as a funding lever, we assume a 35% interest in KXL is sold in 2022 for 9.5x EBITDA.

Coastal GasLink: we assume TRP retains their 35% interest, and that the pipeline enters service in 2024. The base case uses a 10% ROE for the total project (100% interest), and assumes a depreciation rate of just 3%. We do not model a CGL expansion.

Bruce Power: the base case includes more than C$5.0 bln of capital spent through 2030 on refurbishment (assumes all unit refurbishments are approved). We use a 10% ROE for this spend, and a DD&A rate of 2.0-2.5% to capture a 2064 retirement.

NGTL and Canadian Mainline: we assume 6% rate base growth for NGTL and the Canadian Mainline through 2030, which compares to a trailing 10-year rate base CAGR of 8% and -6% respectively. This works out to about C$27.0 bln of spend through the forecast period. Spending through 2023 has already been approved by the regulator. The average ROE on these systems stays flat at ~10% in our model, and normalized depreciation rates are about 6% (in-line with historical).

US Gas Pipelines: we assume 3% average rate base growth at a weighted-average ROE of 11% for ANR, Columbia Gulf, and Columbia Gas. This works out to roughly C$20.0 bln of capital through 2030. Average depreciation rates are just north of 2%, which appears to be in-line with recent history, and makes sense considering most of the rate base is relatively new. The implied rate base growth from this segment of <3% might prove to be conservative.

Mexico Gas Pipelines: the range of outcomes is probably wider here than in other segments, but we hold EBITDA flat through the forecast period once Villa de Reyes is fully ramped up in 2021. Modest capital is spent to maintain existing assets, but no growth capital is deployed in the base case.

Taxes: the trailing 10-year cash tax rate of 8% is likely to rise. We start with 13% in 2020 and increase the cash tax rate to 19% by 2030.

Payout ratio: we assume the EPS payout stays in the 80% range through the forecast period.

Leverage: using credit rating agency methodology, we assume ND/EBITDA rises to about 5.0x in 2023, and gradually falls to 4.5x in 2030. We assume roughly flat fixed charges on debt/prefs/hybrids of 4.5-5.0% through the forecast period.

CAD/USD: with 70% of TRP’s EBITDA generated in US dollars, the exchange rate is material to the Canadian dollar fair value estimate. We use 1.38 as the long-term exchange rate. A 10% change in this assumption changes our fair value estimate by ~8%.

Based on these assumptions, we estimate that fair value for TRP is somewhere in the $75-80/share range (Exhibit O). Another way to think about this is that TRP pays a ~5% dividend yield today, and should be able to easily grow EPS by nearly 4%/year while deleveraging through 2030.

On March 23, 2020, when TRP closed at C$48.45, the market was clearly worried about the earning potential of existing assets. This isn’t a totally unreasonable concern, particularly considering counterparty risks for most of the midstream and pipeline companies in North America. But, in the TRP case, we don’t think it was warranted, particularly considering the cost-of-service nature of the business, the proportion of counterparties that are investment grade (utilities), and the likely offsetting impact of associated gas declines on temporarily reduced gas demand. Part of what prompted this blog post was seeing TRP trade below C$50/share, and identifying a large and clear expectations gap. Unfortunately, it takes us a month to compile all this research, build a model, and formulate a concrete view. In that time, the share price recovered considerably. This is a great reminder that it’s important to maintain working models and up-to-date theses on stocks you’d love to own, so you can act quickly when it’s warranted.

Despite the recent improvement in share price, we still believe an expectations gap exists. In particular, we think our long-term gas demand outlook, and the associated opportunity set for TRP, is greater than what the market price implies. We also feel comfortable ascribing more value to KXL than the market does, and in our experience, many investors aren’t willing to pay anything for large infrastructure projects until they can hear the final screw going into place.

Exhibit P shows a breakdown of how we arrive at our bear and bull case, and in our view, downside risk is low. To arrive at the current share price, a lot of things need to simultaneously go wrong for the company, most of which has lower odds than even of happening. The range of potential outcomes, under most reasonable scenarios, is also relatively narrow. Given the expectations gap, low downside risk, and narrow range of outcomes, we feel comfortable owning TRP shares today.

What would the 10th Man say?

Our gas demand outlook is largely driven by assumptions for the power market, but those could turn out to be wrong. It’s possible that governments around the world adopt more extreme measures to combat climate change, which could result in renewable power generation gaining significantly more market share than we assume, in a much shorter time frame. A drastic step change in utility-scale storage economics, combined with a 0% interest-rate-world, could also make it more palatable for grid operators to see wind and solar generation make up 50%+ of the generation stack. This would eat away much of the growth we expect TRP to capture in their natural gas pipeline businesses, and accelerate the rate at which Keystone and Keystone XL become irrelevant. If the need for new gas infrastructure diminishes, and rates stay low, it’s also likely that regulators revise down allowed ROEs, which would reduce cash flows from some of TRPs regulated assets. In an environment where the growth outlook is diminished, ROEs are reduced, and cash flows from oil pipelines are in question, rating agencies would almost definitely downgrade TRP’s credit rating, resulting in higher interest charges and more potential equity issuance.

Alternatively, nuclear energy could make a comeback. For anyone that’s watched the recent Bill Gates documentary on Netflix, it’s clear that lots of capital is being spent to develop cheaper and safer nuclear reactors. There are numerous hurdles to seeing this become a reality, but it’s certainly possible, and for lots of reasons, we’re totally rooting for companies like TerraPower. If the nuclear tide does turn, this could also erode a lot of future natural gas demand.

If you believe in a near-to-medium term future where either of these scenarios is possible, than a compelling argument can be made to avoid TRP shares at this price. Despite our view that the above scenarios would be great for the world, we clearly think that they are low-probability events.