Investment Thesis

Converge is an IT service provider (ITSP) that specializes in cloud and cybersecurity solutions and has operations in North America and Europe. Shaun Maine incorporated Converge in 2016, IPO’d the company in 2018, and has grown revenue to ~$2.0 bln over the past ~4 years. The core strategy is to consolidate regional and mid-market ITSPs, expand margins on the back of significant cost synergies, and improve customer penetration by cross-selling IT products and services across their various subsidiaries. Converge has acquired 26 companies since inception, averaging about 1.5 deals/quarter, and has performed very well over the past 2-3 years on most other metrics.

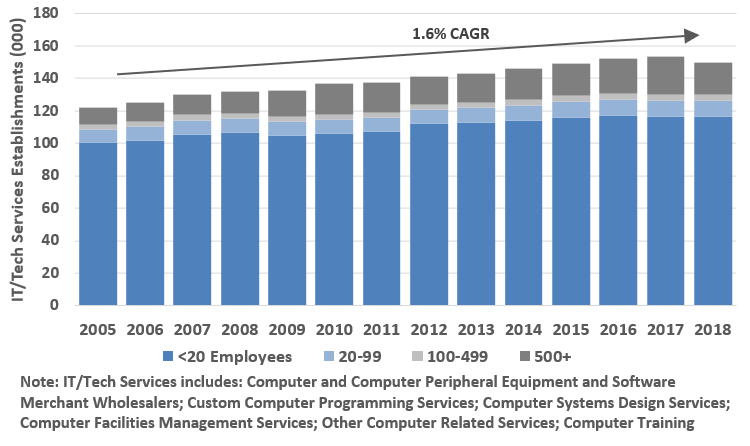

The opportunity to consolidate regional mid-market ITSPs is extremely compelling. This is a highly fragmented industry with a massive runway for M&A and strong secular growth. For context, there’s about 150k businesses in the U.S. IT/Tech Services industry, and ~90% of these have 100 employees or less. Many mid-market ITSPs are also undercapitalized, lack scale, and have limited breadth of solutions, which puts them at a massive disadvantage to larger peers. Excluding synergies, I estimate that mid-market ITSPs in North America sell for somewhere in the 6-10x EBITDA range. For larger acquirers that benefit from scale, cost-synergies like volume discounts and headcount reduction, combined with modest revenue synergies can drop the implied EBITDA multiple to the 3.0-4.5x range.

Scale gives Converge a significant edge over the long tail of mid-market ITSPs, but it isn’t a differentiator vs the larger ITSPs, which offer similar quality and breadth of products and services. Given the opportunity for consolidation, most of the larger competitors are also pursing M&A strategies and benefit equally from scale economies. That said, Converge is at a scale sweet spot where it’s large enough to benefit from scale economies, but still small enough to pursue a mid-market roll-up strategy that moves the needle: i.e. allocate most its free cash flow toward M&A without being forced to pursue larger and/or less accretive deals.

The two biggest risks are that Converge fails to scale effectively, and that competition to acquire mid-market ITSPs increases. In either case, incremental ROIC on M&A would fall faster than I expect. There’s enough supporting evidence and early indications that Converge is managing their integration process well and should be able to increase acquisitions/year while maintaining a low average deal size. I’m not that worried about Converge scaling successfully, but other large ITSPs have struggled with this in the past and so it’s still a risk worth monitoring closely. As for competition, realized 3.0-4.5x EBITDA multiples are too good to last and I expect purchase multiples will increase eventually. However, I expect them to increase slowly and over the next ~decade+ rather than in just a few years. Despite serious consolidation efforts from the likes of Converge, I expect the market to remain extremely fragmented over the next 5-10 years. This industry has strong secular growth, barriers to entry for small ITSPs are low, and technology is changing rapidly. I also expect that Converge will continue to sole-source some of their deals, which should generally result in better prices. Given Converges size, I also expect that they’ll continue to execute on sub-$25 mln deals for a long time, which should be less competitive and come with better incremental ROIC.

I really like Converges management team. Shaun Maine, Converges CEO and founder, is competent, committed to the roll-up strategy, aligned with shareholders, and has a good track record. He’s also done an excellent job building a strong team at Converge. I’ve identified a few governance challenges, but these challenges largely have reasonable explanations, and none are worrisome enough to disqualify the opportunity.

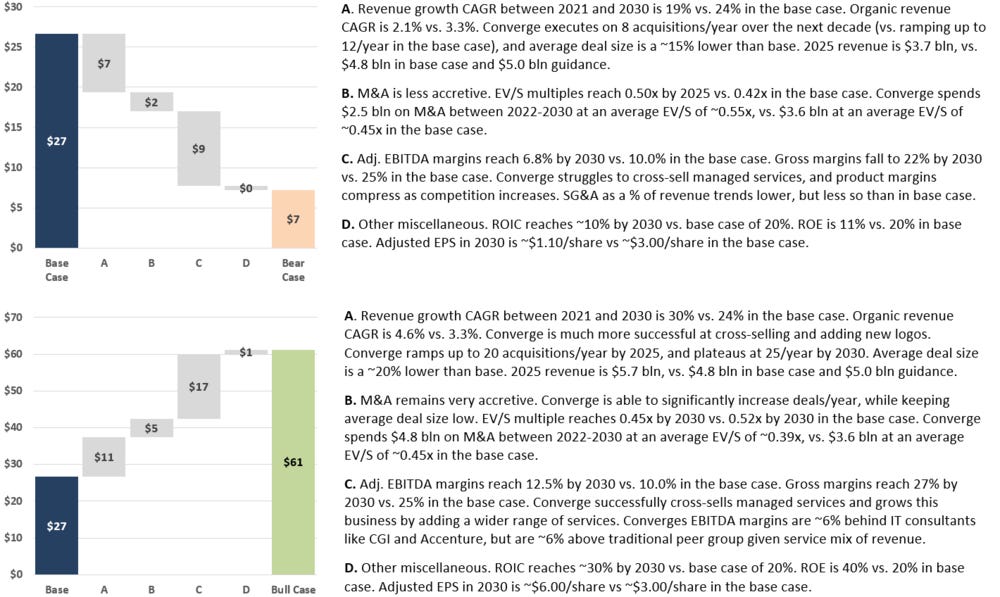

In my opinion, the current share price of ~$9 seems to imply 2-3 years of accretive M&A, and suggests that incremental ROIC will rapidly approach Converge’s cost of capital thereafter. I think the implication here is that Converge struggles to effectively scale and/or competition really picks up over the next 2-3 years. I do assume that M&A eventually becomes less accretive, but that it takes 10+ years for incremental ROIC to converge with cost of capital, and therein lies the opportunity. I expect Converge to spend almost all of their free cash flow on M&A over the next 5-10 years, reaching $5 bln of revenue by 2025 and ~$11 bln by 2030. I also expect Converge’s overall ROIC to reach 20% by 2030, driven by 5-10 years of highly accretive M&A, strong organic growth, and further margin expansion from improving scale economies. My base case suggests fair value is ~$27/share, with my bear and bull case at ~$7 and ~$60, respectively. The risk/return skew at ~$9/share makes this an extremely compelling investment opportunity.

I encourage you to reach out with feedback or comments if you disagree with any of my analysis. I can be reached at the10thmanbb@gmail.com.

Brief History

Gordon McMillan co-founded an IT product and solution value-added reseller called Pivot Technology Solutions in 2010. Shaun Maine joined Pivot in 2011 as the CTO, and eventually went on to become the COO.

Rumour has it that Gordon and Shaun saw an opportunity to consolidate IT service providers (ITSPs) across North America and Europe, but couldn't get the green light to pursue this rollup strategy at Pivot. They attempted to take over Pivot (a publicly listed company) through a privately controlled company and preferred share exchange (link). The proposal ended up getting voted down by the board, and both Gordon and Shaun left Pivot in 2016.

That same year, Shaun incorporated Converge Partners to pursue the roll up strategy, specifically targeting regional ITSPs in North America. Converge made their first acquisition for $30 mln (Corus360) in late-2017, and in late-2018 Gordon joined the company as a director (now serving as an advisor to Shaun). Since inception, Converge has completed 26 acquisitions and grown annualized revenue to over $2.0 bln (Exhibit A). Over that same period, revenue at Pivot was more-or-less flat, and the company ended up getting acquired by Computacenter in 2020 for $105 mln. Converge's equity was valued at nearly $200 mln at the time of the Computacenter deal, and is now approaching $2.0 bln. In my view, Shaun's roll up strategy has created tremendous shareholder value, particularly in contrast to what Pivot has achieved.

The most exciting part of the Converge thesis is their M&A strategy, but before diving into that its worth understanding what an ITSP is, the ecosystem that the company operates in, and the company’s base business.

Value Proposition of an ITSP: Three Pillars

ITSPs can add value to their customers in three distinct ways. First, by providing customers with software, hardware, and services either as a reseller or as a first party. Second, by providing project-based professional services like design, configuration, integration, installation, and implementation. And lastly, by providing ongoing managed services, which I functionally think about as outsourced IT. Exhibit B is a high-level industry map and illustrates where ITSPs fit in the value chain.

ITSPs sit between suppliers and customers, and both sides of that equation are very fragmented. It's simultaneously difficult for customers to effectively select vendors and manage IT spend, and for even the largest suppliers to have a salesforce that effectively reaches every one of these customers. The most basic role of an ITSP is outsourced distribution/sales for suppliers, and outsourced procurement for consumers. For context: Converge has over 250 vendor relationships, in addition to a suite of in-house solutions; CGI has over 150 vendor relationships combined with >150 in-house solutions; Accenture has 185 vendor relationships combined with >8,000 in-house applications and solutions; and CDW offers products and services from over 1,000 brands.

ITSPs clip a fee for reducing friction between suppliers and consumers, but amongst large competitors this portion of the ITSP offering is fairly homogenous. For example, Converge, CDW, CGI, and Accenture are all going to be IBM distribution partners. Some ITSPs differentiate themselves by developing in-house solutions (think of this as exclusive supply), while others may have relationships with unique and under covered independent software vendors (ISVs). Nevertheless, it's difficult to argue that any of these large competitors have a distribution or resale edge over any other competitor. That being said, I would note that the large incumbents likely have a scale advantage over small regional ITSPs. For example, scale gives Converge greater breadth of products/services than a small regional player. As a result, Converge can be a one-stop shop for customers, who might otherwise need to utilize many smaller ITSPs to meet all their needs. Scale also leads to bulk-discounts from vendors, which can lead to better pricing than most small ITSPs can offer.

Beyond utilizing ITSPs for procurement, many customers are also increasingly relying on IT professional services to improve their digital capabilities and to roll-out new IT products and services (project-based work). The increasing complexity, breadth, and depth of IT solutions is making it difficult for most non-experts (and even some experts) to stay informed and up to date. It’s also becoming more difficult for customers to execute on a digital transformation strategy (e.g. solution architecting, installation, and implementation) by relying solely on in-house expertise. One survey by Forrester Consulting (link) found that 81% of IT decision makers (ITDMs) indicate that they need external, specialized technology expertise to be successful. Almost all ITSPs provide some level of professional services today, and can differentiate themselves on breadth and quality of services, reputation, and price. Reputation and price are likely marginal factors. However, in my opinion, breadth and depth of services is a significant differentiator and is a clear advantage that large ITSPs have over their smaller competitors.

Managed IT services are also gaining share. This is essentially any additional service that the ITSP is directly responsible for on an ongoing basis. Outsourcing IT functions to third-party experts can be a more cost-effective and reliable solution than trying to do it all in-house, particularly for small-to-mid-market customers. An example of managed services would be an ITSP managing a customers cloud requirements to improve resource utilization and/or optimizing private and public cloud resources (note that signing-up for AWS would be considered service resale). Another example might be a customer looking to outsource cyber security regulatory compliance or network security monitoring. Like professional services, the success of a managed services business is highly dependent on the talent and quality of IT experts. IT is a mission-critical function, so their must be a high level of trust between the end-customer and the service provider. Breadth and cost are also differentiators and most of this boils down to scale and labor utilization. That said, small ITSP can still enter compete in this part of the value-chain if they can offer the best service for a niche and highly-specialized use case (e.g. offer IP solutions).

Whether it’s resale, professional services, or managed services, one common theme is that scale matters a lot. Scale gives the ITSP better breadth/depth, and likely results in better prices for customers through shared scale economies. The scale advantage differentiates large vs. small ITSPs, but the marginal benefit of scale erodes quickly past a certain point.

Industry Growth

Worldwide IT spending has grown at a +2.0% CAGR over the past decade (link), with the U.S. and Europe growing at ~5.0% (link) and ~3.0% (link), respectively. Growth in Canada seems to be somewhere in the middle. Data from Statista suggests that Worldwide Enterprise software spending has grown at high-single digits, and Data center systems and IT services spending has grown in the ~3-4% range. See Exhibit C for data from Statista.

COVID impacted IT spending in nuanced ways. Some IT spending categories like data centers and hardware were negatively impacted in the first half of 2020, while other categories like cloud solutions, data security, and virtualization accelerated. Most of this was due to the digital sprint in enabling work-from-home (WFH). That said, most data and estimates suggest that COVID has generally resulted in a pull-forward of IT spending (not a borrow from the future). A handful of surveys (e.g. link) suggest that 2022/23 IT budgets will be meaningfully higher than in previous years.

The other takeaway from some of these surveys is that end-customers are not only focused on improving their digital infrastructure and data security to manage WFH, but are becoming more focused on how IT can support long-term strategic goals. This includes improving operational efficiency, customer satisfaction and revenue growth, process and operational reliability, etc. I expect this will lead to higher growth in IT spending beyond 2022/2023, with a handful of additional data points to support this.

First, commentary from Gartner suggested that businesses will be forced to accelerate digital business transformation plans by at least five years to survive in a post-Covid-19 world. We are also seeing more companies create Chief Technology Officer (CTO) roles (at least anecdotally), which should suggest that end-customers are placing a greater emphasis on IT and digitization initiatives. And finally, from what I can tell, the opportunity for digital improvements remains extremely large. For example, results from CGI surveys (from CGI’s AIF) imply that many of their customers still have a long runway on their digitization initiatives and IT improvements.

Converge provides forward looking estimates on some IT spending categories that range from mid-single-digit growth in data centre infrastructure, to mid-teens growth in public cloud adoption (Exhibit D). Some IT spending will be impacted in the short-term by the recent global supply-chain issues (mostly hardware), but software, cloud, and managed services haven’t skipped a beat. As a quick aside, Converge talked about $100-150 mln of delayed revenue in Q3/21 due to current supply-chain issues.

My best guess is that enterprise software, professional services, and managed services will continue to grow in the mid-to-high single digits over the next decade, while public cloud spending (mostly product resale for ITSPs) is likely to be in the high-teens or higher. For reference, Gartner expects global IaaS/PaaS spending to grow at ~26%/yr through 2025. Overall, a very positive secular trend that ITSPs like Converge should benefit from over the next decade.

Converge’s Existing Business

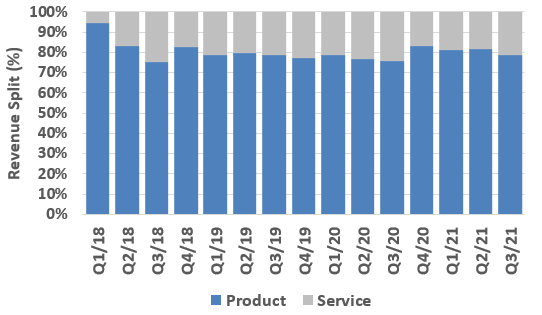

Converge has two distinct segments: Products, which generate ~80% of their revenue; and Services, which generate the remaining 20% (Exhibit E). Product revenue includes all resale (and some first-party sales) activity, while Services revenue includes both professional services and managed services.

Converge’s subsidiaries distribute a wide range of products and solutions that include typical hardware like laptops and mobile devices, business analytic software, AI solutions, blockchain solutions, cybersecurity software, public and private cloud solutions, data centers, networking and storage products, etc. We don’t know the product split between in-house and third-party, but I suspect that it’s mostly third-party products and software today.

Services revenue consists of 25% managed services, and 75% other professional services including cyber security services, cloud computing and analytics, procurement services, staffing services, etc. Approximately 75% of all services are delivered remotely. We also know that ~25% of total revenue is recurring (as of Q3/21), and that about half of this is software subscriptions, a quarter is private cloud and managed services, and the other quarter is from public cloud services. Converge is focused on increasing its managed services as a % of revenue, but progress here is naturally slow and has been mostly offset by the revenue split of new acquisitions.

Across both products and services, Converge has specifically focused on helping customers adopt and manage cloud and cyber security solutions (see Exhibit F). Both cloud and cybersecurity solutions have become major IT priorities for customers of all sizes and continue to grow in importance as businesses become more digital. From what I can tell, some mid-market ITSPs have been slow to expand their offering on these fronts; they either can’t afford to do it well and/or have limited selection. Converge believes that they have a world-class cyber security team and can offer leading cloud solutions, which they believe is a unique offering for most mid-market customers. It’s difficult to validate this, but the limited data I’ve come across suggests that this is probably the case.

Most of Converge’s existing customers are small-to-mid-sized enterprises or state/local governments. From what I can tell, this type of customer is often serviced by either a single regional ITSP that doesn’t offer best-in-class solutions or whole solutions, or by multiple ITSPs, which is inefficient. Most of these mid-market customers also can’t afford to use larger IT consultants like CGI and Accenture where they’d pay a premium for brand name and better customer engagement. As a result, many mid-market customers are lagging behind large enterprises in their digital transformation journey. The data isn’t great, but I estimate that less than 10% of Converge’s customers have implemented and executed on an enterprise-wide digital strategy, leaving lots of room for increasing penetration.

For existing customers, there is a large opportunity to roll out new solutions and capture share by becoming the customers sole ITSP. In addition, some industry surveys suggest that most customers plan to eventually consolidate their IT service providers down from high-single digits (or more) to low-to-mid-single digits, and my guess is that Converge will likely be a beneficiary of this trend amongst their mid-market customers, particularly considering that Converge has a combination of better resale pricing and superior breadth/depth of solutions (including managed services) relative to small regional ITSPs.

This also gives Converge an opportunity to attract new underserviced mid-market customers. The company hosts workshops and technology events to introduce their suite of products, and has been very successful at acquiring new customers through these events over the past few years. Given the growing significance of Converge as a resale partner and distributor, many of these workshops have also been sponsored by vendors (e.g. IBM). Conceptually, this has helped Converge keep customer acquisition costs low, although it’s difficult to quantify. It’s also worth mentioning here that small ITSPs typically have younger and more ambitious sales teams than large ITSPs; hunters not farmers. Acquiring and integrating many small ITSPs has allowed Converge to retain these high performing sales experts and has likely helped them grow organically. This advantage will quickly erode as the company grows over the next few years, but it may give them a small edge over other large ITSPs in the short-term.

After 26 acquisitions and some modest organic growth, Converge now has a diverse customers base by end-market exposure. Exhibit G shows Converges revenue split by end-customer industry in Q3/21, and we can see that no more than 25% of revenue is tied to a single end-market. In addition, the largest 10% of customers make-up just ~20% of revenue. This diversity should help reduce volatility and support a more stable cash flow stream from the existing business.

It’s also worth mentioning that Converge’s customers tend to be sticky. It’s difficult to switch ITSPs once a customer has a relationship with a sales representative who is familiar with their current IT setup and objectives – there is both a convenience and cost factor in switching. Switching costs also increase as customers utilize more products and services – i.e. as penetration increases. It’s easier to switch from a pure distributer than it is to switch from a distributor that also manages IT workloads. Converge doesn’t report customer churn data, but I suspect that churn will decrease over time once customers consolidate their ITSPs and Converge penetration of the average customer goes up with managed services. This should result in growing and increasingly durable cash flows from existing customers, which can support the M&A strategy.

More on my forward looking estimates below, but at the end of 2021 I estimate that Converge’s base business generates over $120 mln/year of adj. EBITDA and can organically grow at low-to-mid-single digits over the next decade. The capital intensity of this business is incredibly low, and likely only requires ~$20 mln of capex and lease payments annually. Including cash taxes and a small amount of interest, Converge is likely generating over $90 mln in run-rate free cash flow today that can be reinvested back into their M&A strategy.

M&A Strategy

Converge’s sticky and stable base business can now fuel its M&A engine, which I view as the most interesting value driver for this business. Converge made their first acquisition in Europe (REDNET) in Q3/21, and now guides to 3-5 deals/yr in North America (down from 4-6 pre-Europe expansion) and 3-5 deals/yr in Europe: 6-10 deals annually. For context, Converge completed 5 deals/year in 2019/2020 (mid-point of guidance) and 9 deals in 2021. Most of this was funded with new equity/debt, but I expect Converge to increasingly depend on internally generated cash flows going forward; more on this in the valuation section.

Converge focuses on the mid-market space, where customers are generally under-serviced and allows Converge to differentiate themselves on both quality of product (cloud and cybersecurity solutions) and breadth of solutions. The way that I see it, Converge is also currently in a scale sweet spot. They are still small enough to pursue a small-to-mid-market roll-up strategy that meaningfully moves the needle (doesn’t yet need to focus on large ITSPs), but are large enough that they have significant scale advantage over the long tail of small ITSPs (which drives synergies). If or when Converge scales beyond just mid-market customers/ITSPs, their ability to differentiate will dissipate, mainly because large ITSPs seem to generally have homogeneous offerings. Luckily for Converge, the mid-market space is extremely fragmented with lots of room for consolidation, and, despite the company’s explosive growth over the past few years, Converge is still small enough to pursue a very attractive M&A strategy here for at least another 5-10 years.

Market Fragmentation

Everything I’ve read on the IT service industry suggests that it’s a highly fragmented space with lots of room for consolidation. Detailed market share data is hard to come by, but there is still some data that can help us understand the opportunity set.

For starters, Converge provides an M&A market map (Exhibit H). The company has identified +150 ideal targets in North America, and an additional +135 targets on the watchlist. Ideal targets are ITSPs with $75-$250 mln in revenue, great IT expertise, and a sticky customer base. In aggregate, that’s over 285 targets that generate ~$130-180 bln of cumulative revenue; roughly ~12%-20% of the $1.1 tln TAM estimate (for U.S. only) that the company provides. It’s important to note that the M&A market map doesn’t include targets with less than $50 mln in revenue, which have accounted for more than half of Converges acquisitions to-date. If we include some of these businesses in their addressable M&A market, it likely doubles the target list.

If Converge was able to acquire ~10 companies/year with average annual revenues of ~$140 mln/target over the next decade (the top-end of current guidance on deals/year and much better than history on deal size), it would still only account for: 1) ~20-40% of the targets identified in Exhibit H; 2) ~10% of the target revenue identified in Exhibit H; and 3) only ~1% of the total U.S. TAM. Clearly there is a big runway for M&A, and my guess is that Converge’s opportunity set is much larger than Exhibit H (including that long tail of targets with sub-$50 mln in revenue). I expect that the company’s watchlist will continue to expand from here, specifically as they expand their European operations and potentially acquire an additional M&A platform in the U.K.

Other sources tell a similar story and validate what the company provides. For example, data from IBISWorld (link) suggests that there are ~467k IT Consulting Businesses in the U.S, with the number of companies growing at ~1.7% from 2016-2022. I was also able to pull the number of IT/Tech Services companies in the U.S. from the U.S. Census bureau. This gave me a lower count than above (150k), but a better break-up by size, see Exhibit I. The biggest takeaway here is that there are currently ~135k IT/Tech Services businesses with less than 100 employees and likely less than $250 mln in revenue (Converge’s target range).

Data on other countries/geographies suggest similarly fragmented markets. The number of IT/Tech Services businesses in Europe has grown at a ~9.5% CAGR between 2012 to 2018 (1.5% in Germany), see Exhibit J. We can also get the average number of employees per business, which is ~5 vs. the U.S. at +100. I’m not confident in this data (Source: link), but the magnitude of the discrepancy suggests that the market in Europe is much more fragmented. In addition, data from a 2019 IBIS World paper and Stats Canada suggest that the Canadian IT Consulting industry is also growing in the low-single digit range and is equally fragmented. For example, ~65% of Professional, Scientific, and Technical Services businesses have less than 100 employees.

Regardless of the geography, this industry appears to be extremely fragmented, which also makes intuitive sense to me. The industry is experiencing strong growth and barriers to entry are low for a small ITSP. There’s limited regulation and minimal start-up costs. It doesn’t take much for a few professionals (both IT experts and sales representatives) to build out a regional ITSP, especially if they offer services in niche verticals or to smaller customers in regional markets. That said, scale can drive meaningful revenue and cost synergies, and given Converge’s size, I believe the company is positioned extremely well to pursue a roll-up strategy with a very-long runway.

M&A Metrics and Synergies

Exhibit K from Converge’s IR deck does an excellent job at laying out the M&A opportunity and the potential synergies that make this strategy so appealing.

At 5.0x EBITDA, and ignoring all synergies, I estimate that Converge would generate a mid-teens IRR on incremental M&A (clearly accretive). Including all revenue and cost synergies, my guess is that Converge would generate an IRR in the mid-20% range. Some of the synergies outlined above are easy to observe and give Converge credit for (like vendor discounts), while other synergies are harder to verify. I’ll walk through each below.

Vendor certifications allow Converge to get volume discounts, which the company has made great progress on over the past few years. Acquired businesses get immediate access to Converge’s certification status (and product discounts), and their product volume gets added to the calculation that vendors use to determine volume discounts. As far as cost synergies go, this is extremely low-hanging fruit and improves EBITDA margins by 1.0-2.0% within 30-90 days. Certain buyers of mid-market ITSPs (like private equity firms) wouldn’t benefit from these volume discounts – at least not to the same degree as Converge – so this feels like a durable edge when competing to acquire small targets.

Head count reduction is self-explanatory, but there are some unique things that the company has been able to do with scale. For example, data from cyberstates.org (link) suggests that tech wages vary significantly across geography, which is something that Converge can take advantage of through integration, consolidation, and scale. Once again, some buyers don’t have this advantage, and I generally view this as more low-hanging fruit for Converge.

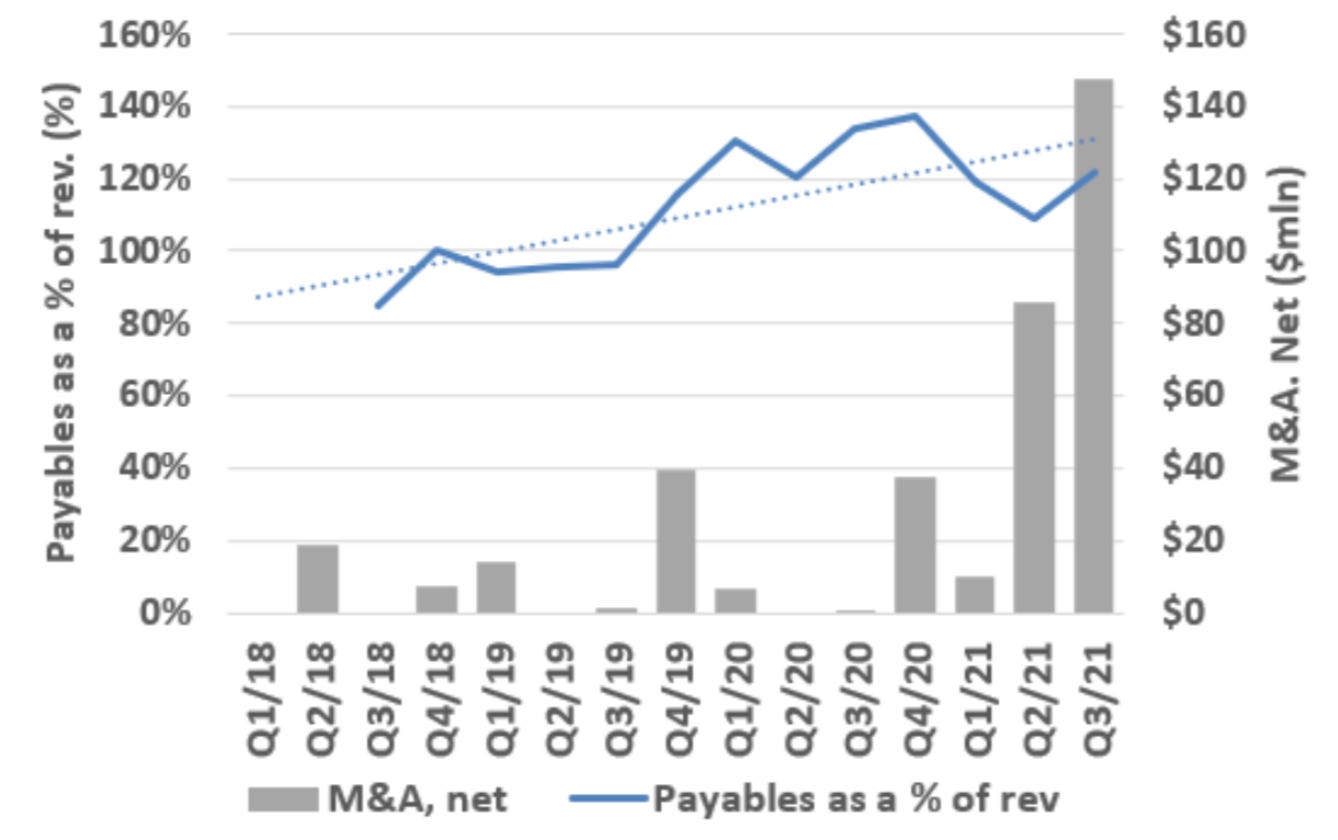

Converge also gets better payment terms with vendors, which allows the acquired business to free up some portion of their working capital. On $100 mln of revenue, Converge believes that they can pull out anywhere form $3-7 mln in working capital. This isn’t the be-all end-all, but it implicitly reduces the purchase price modestly.

Finally, Converge believes they can cross-sell other offerings to newly acquired customers. This includes all products and services across their various subsidiaries, but the company seems to be mostly focused on managed services. These are recurring revenue streams, typically under 2-5-year contracts, and have higher margins than product resale. Rolling out managed services also increases customer switching costs and should help reduce churn/improve net organic growth. Executing on the cross-selling initiatives is dependent on successfully integrating new acquisitions (more on this below), but it also takes time. Management gave a good example of how this cross-sell transition might look:

“It does take longer to get managed services accounts… the upsell on our iSeries is hostings first, then it's service desk where we triaged problems… Then it's managed network. Okay, you need that high bandwidth between all of us like you get in your intranet, let us provide that for you. Then it's managed security, making sure there's no intrusion at the same high-level security you have intranet versus in across the wider area network. And then there's managed end user.”

It's difficult to assess Converge’s track record at cross-selling (including managed services) to newly acquired customers to-date. As an example, organic revenue growth has been lower than what I would expect, but managed services in absolute dollars have been ramping up and in-line with management commentary and guidance. This initiative is still in the first or second inning, so I’m inclined to think that Converge will ultimately succeed at cross selling, particularly as customers demand more services and look to consolidate their ITSP partners.

In summary, the M&A strategy is clear and the runway for consolidation is large. If Converge can effectively execute on this strategy then they should be able to generate a significant amount of shareholder value over time. In my opinion, this isn’t reflected in the current share price.

Risks and Competition

Converge has laid out a very compelling consolidation opportunity. However, there are two big risks to consider: 1) effectively scaling a centralized org. and B) increasing competition.

Effectively Scaling M&A

Converge has historically operated under a centralized model. All subsidiaries are integrated into the larger organization and all capital allocation decision including M&A are made by a single team. This structure has pros and cons. Some of the pros include better opportunities for cost synergies and more concentrated decision making on strategic M&A and capital allocation. However, the biggest drawback is that it will become increasingly difficult to reinvest all of their growing free cash flow. Under decentralized M&A models, a growing free cash flow stream can get deployed by increasing the number of deals/year, without having to increase average deal size (think Constellation Software). Typically, when deal size increases, IRR falls, so the decentralized approach helps keep incremental returns high. While it’s possible to scale centralized M&A with more transactions/year, more often than not this leads to bigger deals, and in turn reduces incremental IRRs.

Historical data suggests that Converge has been able to scale the number of acquisitions they complete without sacrificing incremental returns. That said, I don’t think they can triple the number of acquisitions they complete/year from here under a centralized model, and will most likely see average deal size increase. These larger deals are more competitive on average, and I would expect to see some combination of higher initial prices paid, higher integration costs, and lower cost synergies. For example, larger targets likely have some level of vendor certification already. As a result, Converge would likely fall short of their 1.5% EBITDA margin uplift from better volume discounts. Another example in this case would be rolling out a common CRM or ERP system. One reason for Converge’s success with integration to-date is that many mid-market customers don’t have electronic data interchange (EDI) with these small ITSPs. This has allowed Converge to roll-out their enterprise resource planning software (ERP) to the new targets much quicker than if customers had EDI with the targets existing ERP systems. If Converge’s average target size begins to increase, this benefit will likely shrink, and integration costs could creep higher.

That being said, even under the centralized model, there’s still room for Converge to increase the number of acquisitions they make in a year. The company has met or exceeded their historical guidance on deals/year, which gives me confidence that they can manage at least ~10 going forward (high-end of current guidance). Other successful centralized roll-up strategies seem to be able to execute on at least 15-20 deals/year, and it’s not unreasonable to assume that Converge could eventually follow suit. For context, Accenture was able to execute on 46 deals in 2021 at an average deal size of ~$90 mln (vs. Converge at $8-32 mln depending on the period). However, there’s still some risk that they do this poorly. More deals/year can erode their ability to integrate new targets efficiently and effectively, which is a key driver to unlocking M&A synergies and ensuring an accretive M&A strategy.

One problem that they may run into in North America is increasing regional overlap among a growing number of subs. This could make headcount reduction and labor utilization more difficult to manage, which can lead to lower cost synergies. It may also impact Converges ability to retain key personnel. This can lead to increased customer churn, which can lead to lower-than-expected organic growth. Headcount reduction is never great, and large lay offs can have a profound impact on culture and the attitude of the remaining personnel. Currently, all existing and newly acquired personnel in N.A. report to a single business unit managed by the COO, rather than different group heads (e.g. HR, finance operations, IT professionals, sales reps, etc). This likely makes it easier to manage personnel. However, as the company continues to scale and the number of employees and subsidiaries grow, the COO will undoubtedly have to create another layer of middle management. It’s possible that this leads to lower labor utilization and worse realized synergies on headcount reduction, which currently accounts for a ~1-2% EBITDA margin uplift on new targets. Really successful decentralized organizations like Constellation Software do a good job at limiting middle-management tiers, but that’s rare, and I wouldn’t count on that here.

On this topic, it’s important to highlight that I suspect REDNET will be able to pursue its own M&A strategy in Europe (within certain limits), separate from Converge’s North America operations. Put differently, I expect REDNET will rely on their own M&A team and will be able to purchase smaller businesses without Shaun’s approval. This is essentially one way that Converge can create a semi-decentralized M&A model, delegate M&A decision making, and potentially ramp-up deals/year while maintaining a lower average deal size, and consequently stick to more accretive M&A.

It’s also worth mentioning that Converge has done an excellent job at being transparent and providing detailed information about each acquisition. However, I’ve found a few inconsistencies in their filings from quarter to quarter. This includes results from Accudata, PCD, and ExactlyIT, as well as some inconsistencies in capex from quarterly results to annual results. This isn’t necessarily a red flag to me, and my guess is that the most recent data provided is correct. Nevertheless, this is something I’ll be monitoring closely going forward. If this continues, it could be an early sign that Converge has poor financial controls in place and that integration isn’t as seamless as I first thought.

In summary, from what I can tell Converge has done an excellent job at integrating their subs so far. The company can now integrate new targets within 12 months and has successfully integrated 19 of their 25 acquisitions. There’s also some line of sight to further improvements into 2022. For example, the company plans to roll out a common CRM platform (further saving on licensing and improvement in communication) and better stream-line marketing material across their subs, which should mainly help with cross selling. Converge has also successfully executed on A) more deals, and B) larger deals, while maintaining high-teens to low-twenties IRRs. It’s possible that they lose momentum as they grow, specifically in North America. M&A IRRs could fall due to higher initial prices paid, higher integration costs, and lower cost synergies. This will be a risk worth monitoring closely, with the early warning signs being increasing average deal size with corresponding increase in purchase multiples, hitting the lower-end of guidance on deals/year, or any negative trends in integration costs.

Increasing Competition

The other risk to consider is increasing competition in the mid-market space, which could impact Converge in two ways: 1) more M&A competition could decrease M&A IRRs; and 2) industry consolidation could lead to increased pricing pressure on products and services.

Increasing M&A competition in the mid-market space is probably the company’s greatest risk; regardless of how fragmented the market is, M&A multiples in the 3.0-4.5x EBITDA range (incl. cost synergies) are bound to increase in the future.

For context, Converge has had explosive growth over the past few years, and has spent significantly more on M&A as a % of revenue than their peers despite spending substantially less in absolute dollars. Exhibit L illustrates Converges scale sweet spot mentioned above. The company has guided to ~$5 bln in revenue by 2025, which implies a 25-30% CAGR (21’ to 25’) and massive reinvestment through M&A. At $5 bln of revenue Converge would still rank as one of the smallest ITSPs in this peer group (e.g. CDW, NSIT, CNXN, etc).

The ITSP market remains highly fragmented and given how accretive M&A can be in this industry, I expect that many of the large competitors pursuing M&A from Exhibit L will continue to allocate 2-8% of their revenue towards M&A for the foreseeable future. If consolidation picks up or if more ITSPs and PE firms start pursuing a mid-market M&A strategy, Converge’s opportunity set and excess returns on M&A could erode faster than expected.

There’s a handful of data points suggesting that there’s already plenty of acquirers fishing in this pond: Converge competed with 31 private equity companies on the REDNET acquisition this year. CGI had also recently announced a meaningful increase in planned M&A activity for 2022, targeting the mid-market space in North America. Guidance is for C$0.8 to $1.2 bln of aggregate M&A vs. their trailing 3yr average of ~$400 mln/year. And Accenture has been able to ramp up to +40 deals/year.

It’s also worth highlighting that Converge has only been in a single competitive bidding process: REDNET. Almost all of their other deals were sourced privately where Converge was the sole buyer. My guess is that as Converge continues to execute on this roll-up strategy, they’ll be forced into more competitive bidding processes, and have to pay more to execute on deals as a result.

Despite this dynamic, there are a few reasons to believe that acquisition multiples will rise slowly and over a long period of time. First and foremost, as I discussed above, the market is highly fragmented and thousands of new ITSPs come into existence every year - there is lots of room (likely decades) for small-to-mid-market M&A before the target list consolidates in any meaningful way; especially for the extremely small ITSPs with <$50 mln in revenue.

Another reason is that Converge seems to be a decent place for an ITSP to end-up. Converge invests in each of their acquired companies and their customers, which creates opportunities for growth once the dust settles at Converge. This isn’t the case for all bidders. For example, when Converge initially looked at Germany for acquisition targets (REDNET), they were concerned that Becker had already picked over that market and that few targets would be available and interested in joining Converge. Instead, what they found was:

“Becker favors its top 12 and therefore no companies in the mid-market … want to be bought by Becker because they’re going to become a second class citizen… I was amazed at how wide open the opportunity was for us to acquire quality companies in Germany”.

According to management, Converge won the REDNET bid (despite 31 interested buyers) because the owner (Barbara Weitzel, who will stay on and run Converges Germany segment) believed that REDNET had the highest potential to grow under Converge – in part because of cross-selling potential. Having a good culture and reputation of reinvesting in targets can help Converge win bids at the margin – they aren’t just buying existing cash flows and letting those run their course. Rumor has it that Converge was actually one of the lowest bidders in the REDNET process, but won anyway.

The other point I would make here is that Converge is focused on hybrid cloud solutions and cybersecurity, which are both becoming a very important IT focus for end customers. Offering individual ITSP targets access to cloud and cybersecurity expertise is typically complimentary to their existing suite of products and services. If Converge really does have a world-class cybersecurity team, this may give them an edge against small-to-mid-sized competitors for deals in the short-term.

Finally, I’d reiterate that financial buyers (private equity) likely don’t have the ITSP scale to achieve similar synergies that Converge does. So even if the initial M&A multiple moves higher (IRR falls), Converge should continue to deliver on accretive M&A because of these synergies.

All told, I’m inclined to believe that M&A multiples on acquisitions will increase in the future, but this is likely to happen slowly. Even if this plays out, Converge is likely to earn a return on incremental capital deployed that’s meaningfully in excess of their cost of capital for at least 5-10 years.

On pricing pressure, the larger ITSPs like CDW, CGI, Accenture, etc. are likely offering very similar products and services as Converge. Any difference on quality or breadth of IT solutions between the larger competitors is likely immaterial. Since products and services tend to be homogenous, it’s possible that ITSPs start competing more on price to gain market share, particularly with larger customers, which could result in margin compression to the extent that Converge starts to serve larger customers. While this could play out in the future, we haven’t seen it yet. In fact, prices and margins have generally expanded over the past decade. Exhibit M shows EBITDA margins for selected peers. My guess is that because the ITSP industry remains highly fragmented, the large ITSPs can avoid major competition amongst themselves. However, further consolidation could make price a bigger differentiator. I don’t expect significant pricing pressure over the short-term, but it’s a risk to consider when we look out 5-10 years.

Performance

Converge guides to a 5.0x EBITDA M&A multiple for business with 3% margins, implying that they can acquire ITSPs in the ~0.15x EV/Sales range. They also lay out a fairly convincing path to more than doubling margins within the first 12 months. We have ~23 acquisitions over 15 quarters to validate their success. There are a few discrepancies to guidance, but my general takeaway is that they’ve executed well to-date.

Exhibit N shows trailing annual revenue and EV/TTM sales (including deferred and contingent payments) for acquisitions between Q1/18 to Q3/21. Acquired targets have had TTM sales ranging from ~$1 - $250 mln, with the majority less than $50 mln. Excluding deferred and contingent payments, the median upfront EV/Sales multiple has been ~0.19x compared to guidance of 0.15x. However, if we include deferred and contingent payments, and assume that the average target had ~3.0% EBITDA margins, then Converge’s median EV/EBITDA multiple on acquisitions was closer to 10x, roughly double guidance. If we assume that Converge successfully expanded EBITDA margins from 3.0% to 6.5%, than the median EV/EBITDA multiple (post synergies and including deferent and contingent consideration) was closer to ~4.5x, which would improve further on the back of cross-selling (to 3.0x, optimistically). So far, the data suggests that Converge is paying out all of their contingent considerations, but is also delivering on promised synergies, which means historically Converge is delivering 3.0-4.5x EV/EBITDA on acquisitions.

When we look at corporate EBITDA margins, we get the sense that Converge has been successful at expanding margins post acquisition. Exhibit O shows corporate Adj. EBITDA margins and M&A spend. Margins tend to fall immediately after periods of high M&A, but they typically recover 2-3 quarters afterwards, and the general trend is positive. This makes sense given that it probably takes anywhere from ~90-270 days for Converge to realize the full 3-4% margin uplift from product discounts and headcount reduction.

Improvements in working capital, i.e. unlocking $3-7 mln based on vendor certification and payment terms, is a bit more difficult to validate. However, when we plot payables as a % of revenue (Exhibit P) the data seems to show that they deliver on this as well.

And finally, cross selling has the potential to unlock a lot of value for Converge. If integrated properly, experts and sales reps at acquired ITSPs should be able to approach existing customers with whole solutions that include products and services from the other subs within Converge.

However, I’ll reiterate that cross selling takes time, and even though there’s lots of potential here, my general view is that we don’t have enough good data to validate how successful Converge has been historically. My best guess is that the company has likely been successful with cross selling managed and professional services, but much less so on product and solution resale. That said, in-my-opinion there’s enough qualitative data (e.g. developing an integration approach, successfully integrating 19/24 business, streamlining marketing-materials, management commentary, etc.) that we can expect Converge to be at least partially successful at this going forward.

I also pulled ROIC and Adj. ROIC (excl. special charges and cash position) as a double check on M&A accretion, see Exhibit Q. My general takeaway is that ROIC is improving, and that it’s not unreasonable to expect this to continue as Converge integrates their remaining subsidiaries and continues to scale both organically and through M&A.

In summary, I think the strategy that Converge has laid out makes a lot of sense, and their track record on execution is great. More on my outlook in the Valuation section below, but a lot of what I see in their trailing performance gives me confidence that Converge should continue to be successful with the roll up strategy and on realizing cost synergies, at least in the short-to-medium term. There’s some uncertainty on how successful the company has been (and will be) with cross-selling, but this will take some time and there’s enough qualitative evidence to suggest that they’re on the right path.

Management and Governance

I have mixed feelings about Converge’s management and governance. Let’s start with the positives.

Shaun has plenty of experience in the ITSP industry. He has an excellent track record at both Pivot and Converge, and has come across as knowledgeable, passionate, and competent in many interviews and earnings calls over the past few years. He’s done a great job at laying out the opportunity for shareholders and executing on his multi-year 3-phase strategic plan; see Exhibit R which hasn’t changed since 2017. It’s also reassuring that he’s taken a fair amount of risk to pursue a roll up strategy in the mid-market space: attempting to take over Pivot with Gordon, and then leaving Pivot to start Converge where he invested a significant portion of his personal wealth. Shaun clearly has a lot of conviction on this strategy and has been right to follow-through so far.

Shaun has also built a great a team: Gordon has lots of relevant industry experience, was a successful co-founder at Pivot, and is obviously equally committed to the ITSP roll-up strategy; Cory Reid has +25 years of experience and has executed well on integrating new targets; Greg Berard is another industry expert who’s done a great job with organic net customer additions, among other things; and Barbra Weitzel from REDNET, who’s now going to lead Converge’s European M&A strategy, has a great track-record and reputation, and will be key to Converge successfully expanding in Europe. It’s also worth giving Converge’s Chairman Thomas Volk a shout-out. He joined Converge’s board in May, 2021, and previously led a European roll-up strategy as CEO of Cancom. My bet is that he’ll be heavily involved with Converge’s European expansion.

Insiders currently own 7.5% of Converge (Shaun owns 3.8% and Gordon owns 2.6%), and executive officers are required to invest 25% of their bonuses in Converge stock through open market purchases (which I love - it’s reminiscent of CSU). Performance targets and weights for executive compensation aren’t disclosed, but we do know that they’re based on objective factors and include adj. EBITDA and M&A execution. We also know that management plans to improve their compensation structure in 2022 to include an LTIP portion and TSR metric. The company will present a new compensation structure in the 2022 proxy. All told, given high insider ownership, required open market stock purchases, and soon-to-be-improving compensation structure, I feel good about alignment with shareholders.

As for the negatives, there are two things I struggle with. First, Shaun and Gordon sold ~30% of their stock in Q1/21 – with the benefit of hindsight, this turned out to be a bad decision, and not an early indication of problems brewing beneath the surface. Nevertheless, I would prefer if insiders were net accumulators of stock. Combined with dilution from new equity raises, Shaun and Gordon have seen their ownership interest in the business fall materially (Shaun’s ownership has gone from 20% to 4%). We also note that Greg Berard and Corry Reid sold ~75% and ~35% of their stock respectively in Q3/21. I’m sympathetic with the idea that these executives saw their equity 5-10x inside of two years, and might have personal financial reasons for wanting to tap some of that wealth. It helps that many of these executives still own a significant portion of the business in relation to their net wealth. I can explain away these actions until I’m blue in the face, but it still sows seeds of discomfort.

The second thing that troubles me is that Converge recently sold 47% of Portage CyberTech in a private placement for a $75 mln valuation. Both Shaun and Don Cuthbertson participated personally in the private placement. Shaun, the CEO of Converge, effectively sold a stake in a Converge subsidiary to himself. I’m not jacked about that. The Don component makes more sense – Don is the CTO of Converge and the CEO of Portage, so in theory they are providing more direct incentives to the manager of this subsidiary. It’s worth noting that Converge cumulatively paid just $7 mln to acquire Portage, and the private placement valued the business at 10x that. So, it’s not like Converge was “giving this away”. It’s possible that Shaun wants to pursue a more decentralized M&A strategy (like Constellation Software), where subsidiaries pursue their own M&A. In that model, Shaun might want to incentivize the manager of that subsidiary more directly (hence the private placement) and assume some execution risk on that strategy himself. Sure enough, roughly a month after the private placement, Portage acquired OPIN for $5-$6.5 mln. That said, inter-company dealings always strike me as a little sketchy, even if there might be some reasonable explanation.

In summary, I like that the founder is still CEO and owns a significant stake in the business. I also think that the team is strong, and they have executed well on the strategy to-date. The upcoming revision to compensation plans is encouraging too. At the same time, I’m mildly concerned about insider selling and inter-company dealings. Overall, I’d give Converge a 6/10 on management/governance. In my view, this doesn’t disqualify Converge from the investment universe, but it does increase my hurdle rate.

Valuation

Revenue Growth

Management expects to reach ~$5 bln in revenue by 2025, up from their current run rate of ~$2.0 bln. I’ve tried to not anchor myself to this goal; in my opinion, management teams are typically optimistic on guidance more than 2-3 years out. That said, I believe that there’s a good chance Converge achieves this and my base case estimates are within just a few percentage points of managements target.

I assume organic revenue growth of 5.8% in 2022, falling to 3.5% by 2025 and ~2.0% by 2030. This is slightly higher than what I estimate the company has achieved historically, but there are a few good reasons why. First, the positive industry outlook would support higher organic growth; second, REDNET (~10% of current revenues) is expected to have high double-digit organic growth (~30-40% range in 2022); and third, more targets have been fully integrated and Converge’s integration process has become more efficient, which should let them increase their focus on cross-selling initiatives.

Inorganic growth and net M&A spend is driven by number of acquisitions/year, average annual revenue per acquisition, and an EV/S multiple.

The company averaged ~5 acquisitions/year from 2018-2020, and was able to ramp that up to 9 for 2021. Previous guidance for N.A. was 4-6/year, which has now changed to 3-5/year in N.A. and 3-5/year in Europe; 6-10/year in total. I assume that Converge hits the mid-point of this guidance in 2022; likely doing better in N.A. and being a bit slower in Europe given that they just entered the market. By 2023, I assume that Converge is able to execute on 10 acquisitions/year, and by 2025 I assume that they reach a 12-per-year run rate. We’ve already seen evidence that Converge can centrally scale M&A, and there is some early evidence to suggest that they will start to decentralize M&A, which should help scale further. Shaun seems to be laser focused on this part of the strategy, and other IT companies like Accenture and CGI suggest that Converge could reasonably complete some high-teens number of acquisitions per year. While I think these estimates are reasonable, it’s possible that “risk” is skewed to the upside on this component of the forecast.

I expect that ~50% of these acquisitions will continue to be in the sub-$50 mln of revenue range, largely because: there are plenty of small tuck-in opportunities left in N.A.; most acquisitions made in Germany in the short-term are going to be much smaller than REDNET; and, Portage is likely to execute on a few very small deals/year as Don gets his feet wet. However, given Converge’s current size, they’re likely to also pursue some larger acquisitions going forward. My assumption for 2022 is that Converge acquires four companies with an average TTM revenue of $10 mln, three with $80 mln, and one with ~$220 mln. See Exhibit S for my base case estimates over the next decade.

Converge’s average EV/Sales multiple (including deferred and contingent consideration, and ignoring synergies) on M&A has been in the ~0.3x range. I’ll reiterate that this is much higher than guidance (which ignores synergies and contingent consideration), but still accretive. I expect the average multiple to be in the 0.35x range in 2022, increasing to ~0.5x by 2030. See Exhibit T.

I took a stab at modelling out ROIC for an individual acquisition. At current purchase multiples, once all contingent considerations, synergies, and cross-selling get accounted for, I estimate that Converge is generating incremental ROIC in the high-teens to mid-twenties range. By 2030, the base case assumes that incremental ROIC falls to the 10-11% range.

I expect gross M&A spending to fall to ~$200 mln in 2022 – in part because REDNET was an unusually large deal. However, I expect this to ramp up to $400 mln/year by 2025 and to $550 mln by 2030, which implies that Converge deploys the vast majority of their FCF on new M&A. See Exhibit V.

Overall, I expect revenue to grow at a 24% CAGR from 2021 to 3031, 3% organically and 21% through M&A. See Exhibit W.

Margins

Gross margins have bounced around 24% over the past few years. Service/product split is the biggest drivers of gross margin variability, and we know that services, specifically managed services, have much higher margins than product resale. For context, Insight splits out product and services gross margins, which are ~9% and 53% respectively. See Exhibit X for the relationship between gross margin and services as a % of revenue for Converge and selected peers.

I expect that Converge will successfully cross-sell services to new and existing customers, but that the revenue split from new M&A will be a constant drag (acquired targets initially have a higher product split than Converge). By 2030, I expect services will be ~25% of revenue. I expect that the company’s overall gross margin will expand as a result, but that product gross margin will see some pressure as competition increases and drag down overall gross margins.

SG&A as a % of revenue, which is mostly salaries and benefits, has hovered between 15-20% over the past few quarters/years. Acquisitions will drive this temporarily higher as the company goes through their integration process, i.e. reducing headcount, which I expect to be a constant drag on margins for Converge over the next decade. However, as the company scales and M&A falls as a % of revenue, SG&A as a % of revenue should steadily decline. I assume that this falls from ~17.5% today to ~15% in 2030. For context, Converge’s peer group has SG&A as a % of revenue in the low-to-mid teens.

Overall, I expect EBITDA margins to expand as Converge continues to benefit from scale economies and as services grows as a % of revenue. I expect that EBITDA margins expand by 4% (~2% from higher gross margins, and ~2% from lower SG&A), reaching ~10% by 2030. See Exhibit Y. This would place them at the top-end of traditional ITSPs, but still much lower than the global IT consultants like CGI and Accenture.

Sources and Uses of Cash

As of Q3/21, Converge had no debt, and over $200 mln in cash. The company has historically relied on a combination of equity and debt to fund the roll up strategy, but the recent equity raise was sufficiently large that Converge was able to pay down all outstanding debt. Going forward, I expect that the Converge can likely self-fund (with operating cash flow) the majority of their M&A, with any small delta covered by new debt. The company has done a great job at bringing down their cost of debt, and can now raise sufficiently cheap capital while keeping ND/EBITDA in the 1.0-1.5x range, see Exhibit Z. It’s possible that there’s one or two more equity raises on the horizon, but I think they’d only go down that road if they were flush with opportunities, which wouldn’t necessarily be a bad thing. Exhibit Z shows my expectations for cash inflows/outflows based on the M&A forecast outlined earlier.

Summary

My base case has ROIC increasing from mid-single digits today to ~20% by 2030, and suggests a mid-point of fair value at roughly $27/share. See my model provided above for more details and Exhibit AA for a summary of my estimates.

My scenario analysis gives a fair value range between $7-$60/share, which are meant to represent my best guess at the 10th and 90th percentile outcomes. See Exhibit AB for my assumptions in each scenario.

It’s possible in the bear case that Converge isn’t successful at growing services as a % of revenue and that competition increases pricing pressure, resulting in much lower EBITDA margins than I assume in the base case. In this scenario, there’s much less free cash flow that can be reinvested, and growth through M&A will be much lower than expected.

Alternatively, managed and professional services can make up a larger portion of the business than expected in the bull case. Converge may be more successful at cross-selling than expected, and may add other managed services to their suite either through strategic M&A or organically. Combined with more potential scale benefits than the base case, Converge’s EBITDA margins could be much higher, and the company could have more excess cash to reinvest in M&A. It’s also possible that Converge can more than double the deals that they execute on per year, while maintaining low average deal size – we’ve seen some competitors do this well. In this scenario, Converge has the opportunity to generate a massive amount of value for their shareholders.

I also included Exhibit AC to illustrate these scenarios vs. the current price. In my opinion, the risk/return potential of Converge at ~$9/share is clearly very compelling. My guess is that as Converge continues to execute well on their mid-market roll up strategy over the next 1-3 years, investor will give them more credit for accretive M&A beyond what’s implied by the current share price. In my opinion, this screens as an excellent investment opportunity.

Hello 10th Man,

Would appreciate your take on the Q1 results and change of strategy.

Thanks.

Hi 10th man,

I’m curious what your thoughts are now given the large drop in share price since this deep dive